|

USE THE 14TH AMMENDMENT . . MR PRESIDENT! DON'T GIVE THEM A PENNY!

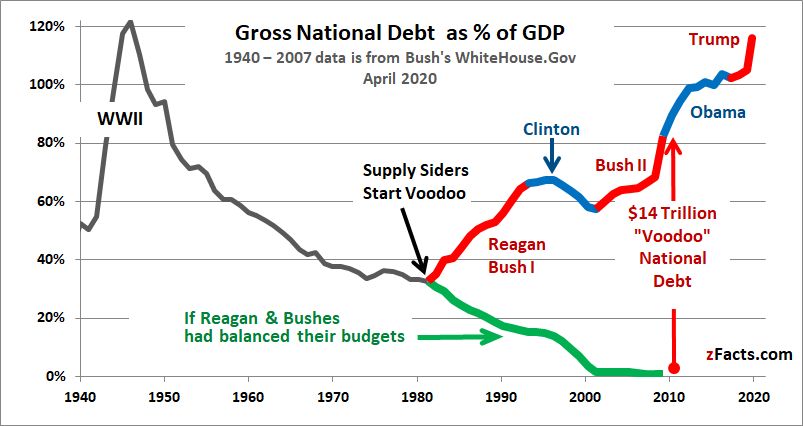

"Simply put, without the wars in Iraq and Afghanistan, the enormous post-9/11 defense buildup, and several rounds of costly, regressive tax cuts, the federal budget would not be $779 billion in deficit, but rather $156 billion in surplus." SEE ARTICLE BELOW PLEASE SEE THE PRIOR POST: REMEMBERING - CHENEY BUSH STOLE B-TRILLIONS DOING 9/11! A NEWS WOMAN CALLED BLD 7 DOWN LIVE ON TV! ROCKEFELLER TOLD RUSSO 9/11 WOULD HAPPEN 11 MONTHS BEFORE AND ROCKEFELLER TOLD RUSSO "SATAN'S MAFIA GLOBAL DEPOPULATION AND POLICE STATE AGENDA!" NO VACCINES FOR POOR COUNTRIES IS SATAN'S MAFIA DEPOPULATION AGENDA! It Is THE END! ENJOY HELL! PLEASE SEE THE MOST IMPORTANT POST ON "GOD'S SITE!" WELCOME TO "THE END OF THE WORLD!" "THANK GOD!" "It Is THE END!" PUTIN STARTS WWIII! 1 "THE FINAL JUDGEMENT" BY 2027! DURING "THE SECOND COMING!" MOST BLESSED - "NORDIC MODEL SUPPORTERS!" THE MOST DAMNED "THE EVIL RICH & RIGHT WING ANTI-CHRISTIANS!" The Budget Farce: A Travesty in Two Acts On today’s X-Date: Watch out for Act II, the annual budget process for the new fiscal year that begins October 1, when Democrats will be playing a weaker hand. BY ROBERT KUTTNER, MAY 16, 2023 Stage One of the manufactured crisis over the debt ceiling is the fast-approaching June 1 X-date, when the Treasury no longer has authorization from Congress to increase the public debt. Stage Two hits next fall when Congress takes up the budget for fiscal year 2024. The two deadlines are legally separate but politically related in several ways, none of them auspicious. The immediate risk is that President Biden bows to pressure from Republicans, Wall Street, media hysteria, and Third Way types in his own party to make a deal with House Speaker Kevin McCarthy to increase the debt ceiling in June in exchange for severe budget cuts in October, either explicitly or by formula. Biden’s message on this is decidedly muddled. He has insisted that he will not engage in budget-cut bargaining as part of the debt ceiling talks, and sources tell me he is resisting pressure to link the two, both in talks with Republicans and in internal strategy discussions. But on Sunday, Biden responded to press questions about the status of the debt ceiling by saying, “You know as well as I do, it is never good to characterize a negotiation in the middle of a negotiation.” According to published reports, those negotiations include non-appropriations matters like rescinding unused COVID aid, imposing stiffer work requirements for federal benefit programs, and enacting permitting reforms. But caps for nondefense appropriations have also been discussed, with White House staff wanting to limit them to two years instead of ten. Any kind of October deal now would break Biden’s pledge. To maintain his resistance, Biden will have to find another way to deal with the debt ceiling. The most obvious way is to invoke the 14th Amendment. But here again, Biden’s public statements have been muddled. He has said he might “consider” taking the 14th as a last resort, but he also suggested that such a course would take too long due to litigation and court review. Treasury Secretary Yellen has unhelpfully added to the mixed messaging, terming the use of the 14th Amendment as provoking a “constitutional crisis.” All of this is just plain wrong. Any lawsuit challenging this use of the 14th Amendment would get expedited Supreme Court review, probably within a week. In fact, there is an active case in federal district court right now. Court-watchers hope that at least five justices, mindful of the stakes, would vote to uphold Biden. Even if Biden does get through the June 1 debt ceiling deadline one way or another, the October situation is worse. For now, Biden has the stronger hand. By holding the debt ceiling hostage, Republicans look like they are playing chicken with the entire economy. If their intransigence causes the United States to default on its debt, they more than Biden will reap the political damage. In October, the dynamics shift. Democrats have a slender majority in the Senate, while Republicans have a narrow one in the House. In such circumstances, it is inevitable for the annual budget to be a compromise with some amount of cutting. That reality must be weighing on Biden’s mind as he considers whether to negotiate a budget deal now as part of a debt ceiling deal and be done with it, or whether to have to go through a game of chicken all over again in October. And October will be a somewhat different game of chicken. If the debt ceiling impasse is not resolved in the next two weeks, the consequence is that the United States defaults on its debt, with dire consequences for the whole economy. But if there is a budget deadlock in October, the result is “only” that the government shuts down while negotiations continue, and not an economic collapse. And a straight-up budget showdown can work to the advantage of the president. This has happened before. In 1995 and 1996, when House Speaker Newt Gingrich forced a government shutdown, for five days in November and then 21 days in December and January over a budget deadlock, President Clinton played the impasse more deftly and Gingrich took most of the political blame; in the end, Gingrich got almost nothing. Similarly, in 2013 Ted Cruz led a 17-day government shutdown in an attempt to repeal the Affordable Care Act; again, Republicans took the blame and the resolution gave them zilch. But in 2011, President Obama, overly eager to cut the recession-induced deficit long before the economy was back to full employment, gave away the store, specifically by conflating the debt ceiling with a budget negotiation. The result was disastrous. The Budget Control Act of 2011 locked in caps on discretionary spending that reduced outlays by a trillion dollars over a ten-year period, with a mandatory sequestration process if Congress could not agree to specific cuts. To be more precise, Obama’s vice president gave away the store, a fellow named Joe Biden. The vice president went around a livid Senate Democratic Leader Harry Reid to cut this deal with his old Senate friend Mitch McConnell. Given his past, there are two ways to read Biden’s likely actions going forward. One is that his whole history suggests that Biden is too eager to make a deal. The other is that this time his own hard-won legacy programs will be on the chopping block, and that he will fight hard to defend them, especially before a re-election that needs a good economy for him to win. Barring a total Biden capitulation, the October standoff is likely to produce the risk of another government shutdown. The best that we can hope is that Biden plays it as well as Clinton did in 1996 and not as badly as Obama and Biden himself played it in 2011. Either way, there will be deep budget cuts because of the divided Congress. The best way to avoid more disabling cuts going forward would be for Democrats to take control of both Houses of Congress in 2024. REPORT MAR 27, 2023 Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio Without the Bush and Trump tax cuts, debt as a percentage of the economy would be declining permanently. CLICKIE FOR ARTICLE FOR IMPORTANT GRAPHS & TABLES The U.S. Capitol Building is reflected in a puddle of melted snow on January 4, 2022, in Washington. (Getty/Anna Moneymaker) Introduction and summaryThe need to increase the debt limit1 has focused attention on the size and trajectory of the federal debt. Long-term projections show2 that federal debt as a percentage of the U.S. economy is on a path to grow indefinitely, with increased noninterest spending due to demographic changes such as increasing life expectancy, declining fertility, and decreased immigration and rising health care costs permanently outstripping revenues under projections based on current law. House Republican leaders have used this fact to call for spending cuts,3 but it does not address the true cause of rising debt: Tax cuts initially enacted during Republican trifectas in the past 25 years slashed taxes disproportionately for the wealthy and profitable corporations, severely reducing federal revenues. In fact, relative to earlier projections, spending is down, not up. But revenues are down significantly more. If not for the Bush tax cuts4 and their extensions5—as well as the Trump tax cuts6—revenues would be on track to keep pace with spending indefinitely, and the debt ratio (debt as a percentage of the economy) would be declining. Instead, these tax cuts have added $10 trillion to the debt since their enactment and are responsible for 57 percent of the increase in the debt ratio since 2001, and more than 90 percent of the increase in the debt ratio if the one-time costs of bills responding to COVID-19 and the Great Recession are excluded. Eventually, the tax cuts are projected to grow to more than 100 percent of the increase. Tax cuts initially enacted during Republican trifectas in the past 25 years slashed taxes disproportionately for the wealthy and profitable corporations, severely reducing federal revenues.Fiscal policy in the postwar eraIn the 34 years after 1946, the federal debt declined from 106 percent of gross domestic product (GDP) to just 25 percent, despite the federal government’s running deficits in 26 of those years. The debt ratio declined for two reasons. First, the government ran a “primary,” or noninterest, surplus in a large majority of those years. This means that, not counting interest payments, the budget was in surplus. Second, the economic growth rate exceeded the Treasury interest rate in a large majority of those years. These two factors—along with the starting debt ratio—are the levers that control debt ratio sustainability.7 With a primary balance, the growth rate need only match the Treasury interest rate for the debt ratio to be stable. The presence of both primary surpluses and growth rates that exceeded the Treasury interest rate created significant downward pressure on the debt ratio.8 The nation’s fiscal pictured changed in 1981 when President Ronald Reagan enacted the largest tax cut in U.S. history,9 reducing revenues by the equivalent of $19 trillion over a decade in today’s terms. Although Congress raised taxes10in many of the subsequent years of the Reagan administration to claw back close to half the revenue loss,11 the equivalent of $10 trillion of the president’s 1981 tax cut remained. These massive tax cuts set off more than a decade of bipartisan efforts to reduce spending and increase revenues, which, along with a booming economy, resulted in budget surpluses at the end of the Clinton administration. Debt ratio stabilization and its drivers In the past few decades,12 there has been considerable discussion and rethinking of what constitutes an appropriate level of national debt. At this point, many experts argue13 that the focus should be on whether debt as a percentage of the economy is increasing or is stable over the long run, not on the amount of debt per se. Understanding the drivers of the increase in the debt as a percentage of the economy is critical to this analysis. While one-time costs, such as those made in response to an economic or public health emergency, increase the level of debt, sometimes by large amounts, they do not increase the rate of growth in the debt ratio over the long run. Debt ratio stability is driven by four components: 1) the size of the primary deficit—the deficit exclusive of interest costs—as a percentage of GDP; 2) the starting ratio of debt to GDP (the debt ratio); 3) the rate of economic growth; and 4) the prevailing interest rate on new Treasury securities.14 The cause of the upward trajectory of the debt ratio—a series of massive tax cuts that have been extended with bipartisan support—are largely responsible for recent budget shortfalls. The underlying fiscal result of Clinton-era policy—having, at the very least, a primary surplus and a declining debt ratio—was projected to persist indefinitely until the Bush tax cuts were made permanent. The Congressional Budget Office’s (CBO’s) last long-term budget outlook before those tax cuts were largely permanently extended15 projected that revenues would be higher than noninterest spending for each of the 65 years that its extended baseline covered.16 In other words, right up until before the Bush tax cuts were made permanent, the CBO was projecting that, even with an aging population and ever-growing health care costs, revenues were nonetheless expected to keep up with program costs. However, in the next year, that was no longer the case.17 As a result of the massive tax cut, the CBO projected that revenues would no longer keep up due to being cut so drastically and, as a result, the debt ratio would rise indefinitely. Tax cuts changed the fiscal outlookAs shown in recent analysis, this new change has further cemented itself;18revenues are now projected to lag significantly behind noninterest spending.19Of particular interest is that projected levels of both revenues and noninterest spending have decreased: Both are projected to be lower than in the CBO’s projections issued before the permanent extension of the Bush tax cuts. This decrease in noninterest spending is the equivalent of more than $4.5 trillion in lower spending over a decade. But the drop in revenue was three-and-a-half times as large, the equivalent of more than $16 trillion in lower revenues over a decade. Despite the rhetoric of runaway spending, projections of long-term primary spending have decreased, but projections of long-term revenues have decreased vastly more. The United States does not have a high-spending problem; it has a low-tax problem. The United States is a low-tax country Compared with other nations in the Organization for Economic Cooperation and Development (OECD), the United States ranks 32ndout of 38 in revenue as a percentage of GDP.20 But it’s not just that the United States is near the bottom end of revenue; it is nowhere close even to the average. Over the CBO’s 10-year budget window, the United States will collect $26 trillion less in revenues than it would if its revenue as a percentage of GDP were as high as the average OECD nation. When compared to EU nations, that number rises to $36 trillion. (see Figure 2) In contrast, the $289 billion projected revenue increase in the Inflation Reduction Act21 still leaves the United States ranking 32nd out of 38 OECD countries. Recent large tax cuts Analytically, the best way to measure why current projections show what they do is to assess what changed relative to older projections. This means looking at what new laws have been enacted. Increases above current levels that were already on track to happen under current law (and thus were already assumed in the baseline) are, by definition, not responsible for the CBO changing its estimate of long-term projections. This means that rising health care and Social Security costs are not responsible for the increased federal debt; the CBO already assumed them, but the CBO also projected sufficient revenue to keep up with rising health care and Social Security costs.22 In fact, the CBO has dramatically lowered the expected growth in health care costs. As this report has already shown, projections of long-term spending, relative to older projections, have significantly decreased and thus have been responsible for decreased, not increased, debt in the CBO’s outlook. It is tax cuts that have caused the dramatic increase in primary deficit projections. The Bush tax cuts The George W. Bush administration, empowered by a trifecta in 2001, enacted sweeping tax cuts that will have cost more than $8 trillion by the end of fiscal year 2023. The tax cuts lowered personal income tax rates across the board, both for labor income and for capital gains, and they significantly increased the untaxed portion of estates and lowered the estate tax rate. These changes were enormously tilted toward the rich and wealthy.23 While these increases were paired with an expansion of the child tax credit and the earned income tax credit, the total package gave significantly greater savings to the wealthy and also made the U.S. tax code significantly more regressive.24 In 2013, a significant majority of the Bush tax cuts were made permanent with bipartisan support, locking in lower tax rates and deep cuts to the estate tax.25 These changes led to a significantly more regressive tax code than existed before the Bush tax cuts were enacted, and one that brought in vastly less revenue. The Trump tax cuts President Donald Trump’s signature tax bill,26 enacted when Republicans gained control of the White House and both houses of Congress in 2017, will have cost roughly $1.7 trillion by the end of fiscal year 2023. These tax cuts reduced personal income tax rates and permanently lowered the corporate tax rate, among other changes. Despite being paired with a further expansion of the child tax credit, the 2017 changes also largely benefited the wealthy, once again making the U.S. tax code significantly more regressive.27 Taken together, the Bush tax cuts, their bipartisan extensions, and the Trump tax cuts, have cost $10 trillion since their creation and are responsible for 57 percent of the increase in the debt ratio since then. They are responsible for more than 90 percent of the increase in the debt ratio if you exclude the one-time costs for responding to COVID-19 and the Great Recession. While these one-time costs increased the level of debt, they did nothing to affect the trajectory of the debt ratio. With or without them, the United States would currently have stable debt, albeit potentially at a higher level, despite rising spending.28 In other words, these legislative changes—the Bush and Trump tax cuts—are responsible for more than 90 percent of the change in the trajectory of the debt ratio to date (see Figure 3) and will grow to be responsible for more than 100 percent of the debt ratio increase in the future. They are thus entirely responsible for the fiscal gap—the magnitude of the reduction in the primary deficit needed to stabilize the debt ratio over the long run.29 The current fiscal gap is roughly 2.4 percent of GDP. Thus, maintaining a stable debt-to-GDP ratio over the long run would require the primary deficit as a percentage of GDP to average 2.4 percent less over the period. Because the costs of the Bush tax cuts, their extensions, and the Trump tax cuts—on average, roughly 3.8 percent of GDP over the period30—exceeds the fiscal gap, without them, all else being equal, debt as a percentage of the economy would decline indefinitely.31 Republican plans for future tax cuts Recent proposals by some Republicans, whose party now controls the House majority, would further reduce revenues. In fact, the first bill passed in the 118th Congress, which was introduced by Rep. Adrian Smith (R-NE) and passed with only Republican votes,32 would rescind all unobligated portions of the $80 billion in funding for the IRS that was provided in the Inflation Reduction Act.33 The Inflation Reduction Act funding for the IRS is projected to pay for itself several times over through increased enforcement of taxes already owed by the wealthy and by large corporations; the Office of Management and Budget estimated that this funding would raise more than $440 billion over the decade.34 Rep. Vern Buchanan (R-FL) has also introduced legislation to make permanent President Trump’s 2017 tax cuts,35 at a cost of roughly $2.6 trillion over the next decade. Conclusion A series of massive, permanent tax cuts have created large federal budget primary shortfalls and continue to exert upward pressure on the debt ratio. In other words, the current fiscal gap—the growing debt as a percentage of the economy—stems from legislation that cut taxes, disproportionately for the very rich. While it is true that the Great Recession and legislation to fight it, along with the costs of responding to the health and economic effects of COVID-19, pushed the level of debt higher, these costs were temporary and did not change the trajectory of the debt ratio. If Congress wants to decrease deficits, it should look first toward reversing tax cuts that largely benefited the wealthy, which were responsible for the United States’ current fiscal outlook. AcknowledgmentsThe author would like to thank Jean Ross for thoughtful comments and Jessica Vela for research support. Methodology The cost of the Bush tax cuts was taken from various Congressional Budget Office and Joint Committee on Taxation (JCT) estimates. The Bush tax cuts and their extensions include the Economic Growth and Tax Relief Reconciliation Act of 2001,36 the Jobs and Growth Tax Relief Reconciliation Act of 2003,37 the Working Families Tax Relief Act of 2004,38 and the Tax Increase Prevention and Reconciliation Act of 2005,39 as well as the alternative minimum tax (AMT) patches in the Tax Increase Prevention Act of 2007,40 the Emergency Economic Stabilization Act of 2008,41 and the American Recovery and Reinvestment Act of 2009.42 They also include the Bush tax cuts, the Lincoln-Kyl estate tax agreement, and the AMT patch sections of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010,43 as well as the extensions of the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 and the permanent AMT patch in the American Taxpayer Relief Act of 2012.44 These estimates include both the revenue and outlay effects of these laws, as well as the increased interest costs from these measures. The cost of the Trump tax cuts was taken from the CBO’s April 2018 baseline.45As with the Bush tax cuts, these estimates include both the revenue and outlay effects of the law, as well as the increased interest costs from the measures. To determine interest costs associated with the Bush and Trump tax cuts, as well as the one-time costs of responding to COVID-19 and the Great Recession, this analysis uses a historical interest matrix. It calculates the interest costs on debt by blending various historical Treasury constant maturities to estimate the effective interest rate on new debt and debt rolled over in any given year.46 The cost of the response to the Great Recession and the COVID-19 pandemic includes the Economic Stimulus Act of 2008,47 the American Recovery and Reinvestment Act of 200948 (minus the AMT patch,49 so as not to double count), the Troubled Assets Relief Program actual costs as recorded,50 the Coronavirus Preparedness and Response Supplemental Appropriations Act of 2020,51 the Families First Coronavirus Response Act,52 the Coronavirus Aid, Relief, and Economic Security (CARES) Act,53 the Paycheck Protection Program and Health Care Enhancement Act,54 the COVID-19 provisions (Divisions M and N) of the December 2020 omnibus,55 and the American Rescue Plan.56 These costs were run through the historical interest matrix to calculate interest costs. The Reagan tax cut cost was estimated using the cost (as re-scored in President Reagan’s final budget) as a percentage of projected gross national product (GNP).57 The average size of the cut as a percentage of GNP was then applied to current GDP estimates. The cost of extending the Trump tax cuts was estimated using the CBO’s May 2022 baseline58 estimates of the individual income tax cuts and the higher estate and gift tax exemptions. These components were extrapolated out a year to 2033 and adjusted for the CBO’s February 2023 baseline GDP projections.59 The OECD nominal revenue comparisons were estimated using the difference between the average OECD/EU member nation’s revenue as a percentage of GDP and the United States’ revenue as a percentage of GDP60 and then multiplying that percentage-point difference by the current GDP estimates as projected in the CBO’s February 2023 baseline.61 The data underlying the figures in this report can be downloaded here. If Not for Republican Policies, the Federal Government Would Be Running a Surplus Prepared by the minority staff of the Senate Budget Committee CLICKIE FOR THE ARTICLE PDF WITH THE IMPORTANT GRAPHS AND TABLES, THEY WOULD NOT COPY Introduction In 2000, the federal government ran a surplus of $236 billion. The next year, the Congressional Budget Office projected that over the following ten years, the accumulated surplus would add up to $5.6 trillion – $889 billion in 2011 alone.1 For the recently-completed fiscal year, 2018, the federal government ran a deficit of $779 billion.2 What contributed to the $779 billion deficit in 2018?

Simply put, without the wars in Iraq and Afghanistan, the enormous post-9/11 defense buildup, and several rounds of costly, regressive tax cuts, the federal budget would not be $779 billion in deficit, but rather $156 billion in surplus. The story of how the federal government turned projected surpluses into deficits is one of two decades’ worth of Republican policies that amounted to a massive transfer of wealth from working families and middle-class Americans to the wealthiest individuals and largest corporations in the country. Even worse, these were policies that put our armed forces in the middle of immutable quagmires overseas that have left thousands of American troops – and thousands of Iraqi, Afghani, and other civilians – dead, and thousands more dealing with injuries for the rest of their lives. In short, the last 20 years of federal policymaking have been a disaster for our economy, for our health, and for our standard of living. Tax Cuts Despite 40 years of Republican rhetoric on how tax cuts “pay for themselves” through increased economic growth, there has been one consistent problem: It is not true. President Reagan’s own Fiscal Year 1990 budget, reported that his 1981 tax cut would reduce federal revenues by $397.6 billion in 1992 alone, a 27 percent reduction.5 This is the equivalent (as a percent of the revenue base) to a 10-year, $11.5 trillion tax cut today.6 In fact, Reagan’s tax cuts were so fiscally unsound that, over the remainder of his term in office, he was forced to sign into law tax hikes that would be the equivalent to a 10-year, $6.2 trillion tax increase today.2 Not learning the lesson of the 1980s, President George W. Bush came into office promising that his proposed tax cuts would, according to the Heritage Foundation, effectively pay off the national debt by 2011.7, 8 Facing a recession at the beginning of his presidency, Bush’s response was not temporary stimulus, but rather the massive tax cuts that he had campaigned on – tax cuts that gave as much as 38 percent of their benefits to the top 1 percent9 and were, for the most part, eventually made a permanent feature of the tax code. Including their various expansions and extension, the Bush Tax Cuts contributed nearly $500 billion to the deficit in 2018. Without the Bush Tax Cuts, the national debt, as a percent of the economy, would be more than 25 percentage points lower today. President Trump did not have the pretense of an economic slump to pass his tax cuts in December 2017 – it was simply Republican orthodoxy that tax cuts for the wealthy and large corporations would trickle down to working families and would magically pay for themselves. Ultimately, the tax cuts that did pass are projected to add $1.9 trillion to the debt over 11 years10 and provide more than 83 percent of their benefits to the top 1 percent.11 In all, the Trump Tax Cuts – which coupled permanent corporate tax cuts with temporary individual tax cuts – added $164 billion to the 2018 deficit. Wars Almost every war that the United States has fought, beginning with the War of 1812, has been at least partially paid for or offset by increasing federal revenue. During the Civil War, President Abraham Lincoln instituted the first ever income tax in American history. The Spanish- American War, both World Wars, the Korean War, and the Vietnam War were all funded through increases in federal revenue. In fact, during the Korean War, income tax rates were as high as 91 percent; they remained at that level through the entire Eisenhower administration. However, President George W. Bush did not raise revenue to offset the costs of the wars in Iraq and Afghanistan. Since 2001, Congress has appropriated more than $2 trillion specifically for overseas conflicts. Because of this spending, in Fiscal Year 2018 alone, the deficit was $127 billion higher because the United States did not pay for American military involvement in these conflicts. In addition, Congress vastly expanded the “base” defense budget in the wake of 9/11, expanding military capabilities separate and apart from the direct warfighting effort. This defense buildup added an additional $156 billion to the deficit in 2018. 123 Other Policies Contributed to 2018’s Deficit This analysis shows that without Republicans’ tax cuts, war-fighting, and defense build-up since 2001, the federal budget would have been $156 billion in surplus. Instead, the 2018 deficit was $779 billion. Of course, this analysis leaves out other policies that likely contributed hundreds of billions of dollars more to the deficit in 2018. First, the more than $200 billion cost in 2018 alone of our response to the attacks on September 11, 2001 is not comprehensive. The approach used above included only the funding explicitly designated for war and base defense increases. It therefore does not include any increased cost to the Department of Veterans Affairs (VA) associated with increased overseas conflicts. Further, this analysis omits the costs of the 2008 Great Recession, which was caused, prolonged, and worsened by the greed, fraud, and recklessness on Wall Street precipitated by the deregulation of the financial sector. The Great Recession eliminated 8.7 million jobsa and reduced average family wealth by more than one-quarter.b And it continues to have a significant impact on the federal budget: The combined cost of the revenue loss and automatic increase in safety-net spending that resulted from the Great Recession contributed $41 billion to the deficit in 2018 and increased the debt by 9 percent of GDP, when interest costs are included. These figures do not even count the costs of the American Recovery and Reinvestment Act of 2009 (“the stimulus”). ________ a Center on Budget and Policy Priorities, “Chart Book: The Legacy of the Great Recession,” 27 September 2018. https://www.cbpp.org/research/economy/chart-book-the-legacy-of-the-great-recession b McKernan et al, “Impact of the Great Recession and Beyond: Disparities in Wealth Building by Generations and Race,” Urban Institute, 21 April 2014. https://www.urban.org/research/publication/impact-great-recession-and-beyond Opportunity Cost In addition to the budgetary costs of burdening the federal budget with military spending and regressive tax cut, there is an enormous opportunity cost of what the federal government could have otherwise done with the same dollars. If we had not spent $935 billion on the military and tax cuts in 2018 alone – or if the costs had been offset – we would have run a $156 billion surplus. That means the federal government could have paid for any of the following proposals – multiple times over for some – in Fiscal Year 2018 and still balanced the budget.

1 Congressional Budget Office, “Changes in CBO's Baseline Projections Since January 2001,” 7 June 2012. https://www.cbo.gov/publication/41463 2 U.S. Department of Treasury, “Mnuchin and Mulvaney Release Joint Statement on Budget Results for Fiscal Year 2018,” 15 October 2018. 3 Includes costs of subsequent expansions and extensions. See Methodology section. (This, and the following figures, include resulting interest costs.) 4 Solely includes Overseas Contingency Operations appropriations. 5 Federal Reserve Bank of St. Louis, Budget of the United States Government, Fiscal Year 1990.https://fraser.stlouisfed.org/files/docs/publications/usbudget/bus_1990.pdf 6 Figure based on the average tax cut over the five-year period provided by the President’s Budget of 25.9 percent. 7 Beach, William and Wilson, D., “The Economic Impact of President Bush's Tax Relief Plan,” The Heritage Foundation, 27 April 2001.https://web.archive.org/web/20110308142121/http://origin.heritage.org/Research/Reports/2001/04/The-Economic- Impact-of-President-Bushs-Tax-Relief-Plan 8 The Heritage report implies that the Bush Tax Cuts would cause the debt to be paid by 2011; however, even this report acknowledges the tax cuts would lose some revenue. Nonetheless, the report projects that the debt-to-GDP ratio would be lower in 2011 with the tax cuts (4.7 percent) than if the tax cuts were not passed (4.8 percent,7 according to CBO’s January 2011 baseline. See: Congressional Budget Office, “The Budget and Economic Outlook: Fiscal Years 2002-2011,” 1 January 2011. https://www.cbo.gov/publication/12958) 9 In 2010. See: Citizens for Tax Justice, “The Bush Tax Cuts Cost Two and a Half Times as Much as the House Democrats’ Health Care Proposal,” 8 September 2009. https://www.ctj.org/pdf/bushtaxcutsvshealthcare.pdf 10 Congressional Budget Office, “The Budget and Economic Outlook: 2018 to 2028,” April 2018. https://www.cbo.gov/system/files?file=115th-congress-2017-2018/reports/53651-outlook.pdf#page=133 11 In 2027. Tax Policy Center, “T17-0316 - Conference Agreement: The Tax Cuts and Jobs Act; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2027,” 18 December 2017. https://www.taxpolicycenter.org/model-estimates/conference-agreement-tax-cuts-and-jobs-act-dec-2017/t17-0316- conference-agreement 12 It goes without saying that the cost to federal budget is intimately less important than the loss of blood and life that our nation’s soldiers, seamen, airmen, and Marines have paid during these conflicts. According to data from the Department of Defense, 4,423 Americans have been killed in Iraq since 2003. (See: https://dod.defense.gov/casualty.pdf.) An additional 31,958 Americans have returned home wounded as a result of the misguided war in Iraq. Although estimates vary, roughly 194,000 to 222,000 Iraqi civilians have been killed since the United States invaded their country in 2003. (See: Brown University, Watson Institute of International & Public Affairs, “Costs of War.” https://watson.brown.edu/costsofwar/figures/2016/direct-war-death-toll-iraq- afghanistan-and-pakistan-2001-370000) 13 West, Rachel. “For the Cost of the Tax Bill, the U.S. Could Eliminate Child Poverty. Twice.” Talk Poverty, 12 December 2017. https://talkpoverty.org/2017/12/12/u-s-eliminate-child-poverty-cost-senate-tax-bill/ 14 American Society of Civil Engineers, “2017 Infrastructure Report Card,” 2018. https://www.infrastructurereportcard.org/the-impact/failure-to-act-report/ 15 National Academies of Sciences, Engineering, and Medicine.” Transforming the Financing of Early Care and Education,” February 2018. http://sites.nationalacademies.org/DBASSE/BCYF/Finance_ECE/index.htm 16 West, Rachel. Op. cit. 17 Congressional Budget Office data. 18 Sanders, Bernie. “The College for All Act: Fact Sheet,” 3 April 2017. https://www.sanders.senate.gov/download/the-college-for-all-act-fact-sheet?id=A2524A5A-CA3F-41F8-8D93- DD10813DC384&download=1&inline=file 19 U.S. Department of Agriculture, “Supplemental Nutrition Assistance Program Participation and Costs,” 7 September 2018. https://fns-prod.azureedge.net/sites/default/files/pd/SNAPsummary.pdf 20 Congressional Budget Office data. 21 West, Rachel. “Yes, America Can Afford to Dramatically Reduce Poverty and Increase Opportunity,” Center for American Progress, 14 April 2016. https://www.americanprogress.org/issues/early- childhood/reports/2016/04/14/135547/yes-america-can-afford-to-dramatically-reduce-poverty-and-increase- opportunity/ UP FRONT

What we learned from Reagan’s tax cuts David Wessel Friday, December 8, 2017 The tax bill speeding through Congress is being sold – by its advocates – as so good for the economy, that it will boost growth and offset any losses from the cuts. Those of you who were around in the 1980s might be feeling a sense of deja vu, especially when you recall what Ronald Reagan had to say back in 1981. “We presented a complete program of reduction in tax rates. Again, our purpose was to provide incentive for the individual, incentives for business to encourage production and hiring of the unemployed, and to free up money for investment.” I revisited the 1980s in a recent conversation with NPR’s Morning Edition. You can listen here. Here’s the gist of what I had to say. Q. Did the 1981 Reagan tax cut spur enough economic growth that it paid for itself? A. When Ronald Reagan arrived in Washington in 1981, circumstances were very different than they are today. Inflation was nearly 10 percent. The Federal Reserve had pushed interest rates into double digits. The federal debt was about half what it is today, measured as a share of the economy. The Reagan tax cut was huge. The top rate fell from 70 percent to 50 percent. The tax cut didn’t pay for itself. According to later Treasury estimates, it reduced federal revenues by about 9 percent in the first couple of years. In fact, most of the top Reagan administration officials didn’t think the tax cut would pay for itself. They were counting on spending cuts to avoid blowing up the deficit. But they never materialized. Q. So the spending cuts never materialized, the deficit increased, and then what? A. As projections for the deficit worsened, it became clear that the 1981 tax cut was too big. So with Reagan’s signature, Congress undid a good chunk of the 1981 tax cut by raising taxes a lot in 1982, 1983, 1984 and 1987. George H.W. Bush signed another tax increase in 1990 and Bill Clinton did the same in 1993. One lesson from that history: When tax cuts are really too big to be sustainable, they’re often followed by tax increases.

0 Comments

Leave a Reply. |

"ONE LOVE"

"GOD'S LOVE!" PERMANENT . . CEASEFIRE! . . NOW! . .

TWO STATES! . . NOW! ISRAEL AND US WANT THE WATERFRONT OF GAZA AND THE OIL OFFSHORE OF GAZA!

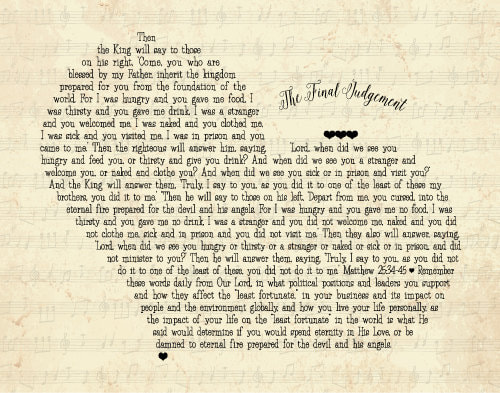

VLAD WANTS UKRAINE'S GAS OIL PIPELINES FOOD PORTS AND DOESN'T WANT NATO ON ITS DOORS. CHENEY & BUSH . . THE EVIL RIGHT WING ROCKEFELLER TOLD US ON LAST 13 MIN OF ZEITGEIST DID 9/11, DOING GENOCIDE IN IRAQ & AFGHANISTAN TO TAKE OVER THE MIDDLE EAST THEN VENEZUELA WITH PLANS TO CHIP EVERYONE! KILLING THOSE THAT STOOD AGAINST THEM! GLOBAL GENOCIDE! "THANK GOD!" . . "IT IS . . THE END!" . . OF "RUTHLESS RULE" . . BY "THE EVIL RICH!" AMEN! UPDATED . . THE MOST IMPORTANT POST ON GOD'S SITE: "ENTER THE NARROW GATES!" TRUE NORDICS! THE GREEN PARTY! JILL STEIN BERNIE AOC THE SQAD! WIDE & BROAD ARE THE GATES TO HELL! TOTALITARIAN GANGSTER CAPITALISM & SOCIALISM! FORETOLD! "DONNY THE DEVIL!" OF SATAN'S EMPIRE! DAMN TRANS/GTLBX = GOD DAMNS U! SIBERIAN METHANE + HOT HOUSE EARTH + AMOC SHUTDOWN = "THE SIBERIAN MONSTER HURRICANE BERYL!" CAT 6! 150 F PLUS! SOON! "HOT STUFF!" "THE SIBERIAN METHANE MONSTER!" CAUSES THE METHANE HEAT WAVE AND SURFACE FIRESTORM! THE FIREY WAVES OF DEATH! BY 2027-30! CHRIST LAID OUT IN THE 1,500 TO 2,000 UNIQUE WORDS THAT THEY ESTIMATE HE SPOKE IN THE GOSPELS, THAT SUPPORTING . . "THE NORDIC MODEL" . . IS THE PATH TO ENTERING . . "THE NARROW GATES" . . INTO ETERNITY IN CHRIST'S / GOD'S HEAVEN. "THE FINAL TESTAMENT," WHICH I HAVE LAID OUT HERE. CHRIST TOLD ME TO JUST USE HIS WORDS HERE, TO SHOW THAT CHRIST . . "LOGICALLY" WAS THE FIRST . . RADICAL PACIFIST ANTI-WAR LIBERTARIAN DEMOCRATIC MARKET SOCIALIST . . THE FIRST NORDIC MODEL ECONOMIST! THE LOGIC OF THE GOD OF LOVE! NOTABLY A DANE. AS THE DANES HAVE PROVEN BY . . "THE FRUITS OF THEIR EFFORTS" . . THAT THEY HAVE CREATED THE MOST . . SUSTAINABLE HUMANE AND EGALITARIAN SOCIETY . . "AS IT IS IN HEAVEN! SO SHOULD IT BE ON EARTH!" . . THEY ARE MOST BLESSED NOW & IN HEAVEN! THE NORDICS, NOTABLY THE DANES, HAVE CREATED THE MOST BLESSED SOCIETIES/Y THAT . . "TAKES CARE OF THOSE IN NEED!" THE PRIMARY CRITERIA CHRIST SAID WILL DETERMINE IF YOU ARE BLESSED TO LIVE FOR ETERNITY IN HEAVEN, IN THE FINAL JUDGEMENT! NOT! THE RUTHLESS GREED FOR MONEY FOR THE SUPER RICH! BE BLESSED! SUPPORT . . THE NORDIC MODEL! . . BERNIE AOC THE SQUAD, THE TRUE PROGRESSIVES SUPPORTING . . "GOD'S MODEL!" . . "THE NORDIC MODEL!" The Purpose of Life Pray "Help Me To Love Others The Way YOU Love Me!" This IS ALL YOU NEED to Become One With God! I LOVE YOU SOO MUCH! "JC!" THE GOD OF LOVE!

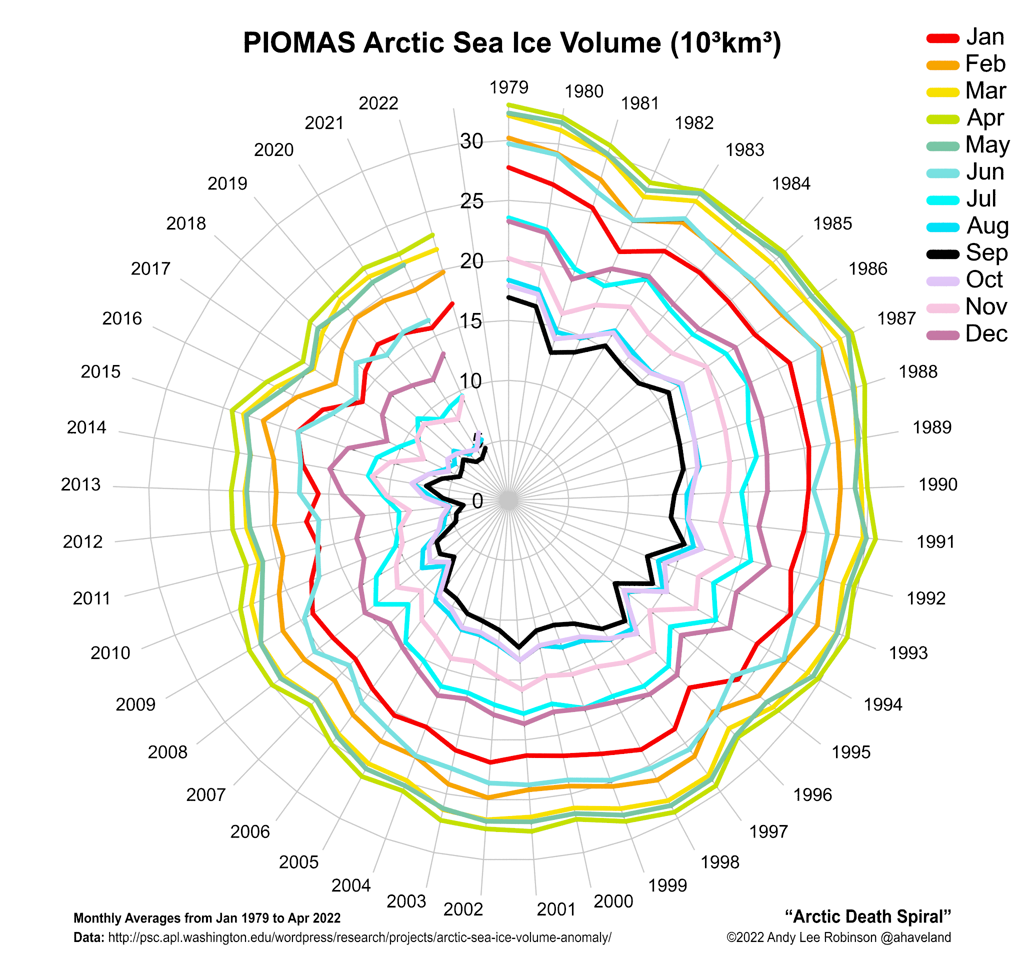

JIM'S SUGGESTIONS: PRACTICE FOR HEAVEN! "LIVE LIKE THE PLANET IS DYING!" It Is THE END! LOVE MORE, AND LOVE MORE PEOPLE! TRY! FIND A CAUSE! GIFT AS MUCH AS YOU CAN! TO "THOSE IN NEED!" GIFT MOST OF YOUR WEALTH TO GOD! TO "THOSE IN NEED!" IF YOUR EVIL GREED HAS ENGULFED YOUR SOUL! IF YOU ARE VERY RICH! SUPPORT "AS IT IS IN HEAVEN, SO SHOULD IT BE ON EARTH!" SUSTAINABLE, HUMANE AND EGALITARIAN! "THE SHE NORDIC MODEL!" JILL STEIN BERNIE AOC & THE SQUAD! AND . . "BECOME ONE!" REALLY OPEN YOUR LIFE TO GOD'S LOVE! GOD WANTS TO BE YOUR BFF! LET GOD GUIDE AND FULFILL YOU! LOVE GOD WITH ALL OF YOUR PASSION! EVERY DAY! IF YOU DON'T BELIEVE IN GOD! BE A "GOOD HUMANIST!" AND . . "I WILL SEE YOU IN HEAVEN SOON!" JIM "JAZZIE" GOD'S TRANS GENDER DAUGHTER. CHANNEL FOR WRITING "THE FINAL TESTAMENT OF JESUS SARAYU MAMMA AND FATHER GOD!" "THE ONE!" TRANS MRS DENMARK! DANISH CHRISTIAN HUMANIST! FOCUSED ON "THOSE IN NEED!" IN MY DREAMS! VERY FEM! THE PRIMARY CHANGE FROM 2016 GENDER SOCIETY OVERVIEW BELOW. WHERE I FORECAST 2100 FOR "ICE FREE ARCTIC" WAS THE START OF MASSIVE METHANE RELEASE DOCUMENTED FROM 2016-2017.

IN 2017 DR. PETER WATAMS CAMBRIDGE FORECAST "ICE FREE ARCTIC" BY 2025! CHRIST SAID, THIS IS WHEN "MY MOST PROFOUND PROPHECY" WILL BE FULFILLED! AT THE END TIMES, IT WILL BE LIKE NOAH & SODOM & GOMORRA, ONE DAY NORMAL, NEXT HELL ON EARTH.

GOD’S . . JC’S . . PROGRESSIVE NEWS, SCIENCE & TRUE CHRISTIANITY! . .

. . “THE LIBERATION THEOLOGY OF JESUS CHRIST!” . . “JC!”. . . . “ALL TRUTH!” . . . . “NO LIES!” . . TO HELP PREPARE . . . . “YOUR SOUL!” AS . . . . “It Is THE END!” . . . . . . “SAVE YOUR SOUL!” . . . “BECOME ONE!” NOW! PLUS . . . . . . MORE PROGRESSIVE NEWS, INSIGHTS AND ANALYSIS . . IN 1 POST . .THAN CNN IN A YEAR! CHRIST STATED: I HAD TO COME TO TELL "YOU" "MY FATHER'S WILL!" WHICH MY FATHER HAS UPDATED TO TODAY! ON "GOD'S SITE!" SOON! "YOU" WILL BE JUDGED! BY HOW "YOU" "DO MY FATHER'S WILL!" "TAKE CARE OF THOSE IN NEED!" NOT "YOUR EVIL GREED!" OR "FRY BABY FRY!" IN THE IMPACTS OF "YOUR EVIL GREED!" . . VERY SOON! "The Spirit of the Lord is upon me; he has anointed me to tell the good news to the poor. He has sent me to announce release to the prisoners and recovery of sight to the blind, to set oppressed people free, and that the time of the Lord ’s favor has come.” Luke 4:18-19 Christ's Message is . . Good News for The Poor Imprisoned Blind and for The Oppressed! It is . . "The Last Warning" for . . THE EVIL RICH and The Oppressors! The EVIL Republicans Right Dems Right Independents and Right Anti-Christians! Support The Nordic Model Now! Gift Your Evil Income & Wealth! Or Fry in Hell You caused! "Depart From ME!" "Ye" "That Have Worked" . . "The Most Evil Iniquity of Wealth, Income & Justice! Of ALL TIME!" "To THE REST!" . . Do what Tori sings so amazingly in the first video. Pray "Help Me To Love Others The Way YOU LOVE ME!" Support "As it is IN HEAVEN!" Sustainable Humane and Egalitarian . . "The Nordic Model!" Bernie / AOC / The Squad! Now! Gift as much as you can! Little did I know over the past 20 plus years of going to Maui, our favorite spot, and laughing at the sign below, that "Christ" would select me to "prepare the way!" Truly "Jesus Is Coming Soon!" By 2025-2030! Soon after "The ARCTIC is Ice Free!" The Spiral below goes to Zero! Prepare your Souls! . . NOW! THESIS SUMMARIES & Key Links SideBar Below THE FINAL TESTAMENT OF JESUS CHRIST! “THE LOGICAL GOD OF LOVE!”

"MY HIS STORY" My journey with "JC!" My BFF! The Only Reason! "Become One!" NOW! In process but most is here or on my "Jazzie" page. "JAZZIE" . . "LITTLE Jc" My Trans story written in spring 2016. "His Site" was launched in 8/2015. Amazing how little has changed! Need to join Gender Society to read bios! The primary NEW INFO. Methane Release has skyrocketed! Which I have documented here! Hence, "It Is THE END" by 2030! Not by 2100! CLICK HERE FOR THE PDF FILE! . . OF . . "JAZZIE!" . . "LITTLE Jc!" VISIT GENDERSOCIETY! PROVING . . CHRIST'S MOST PROFOUND PROPHECY! . . BY 2022 TO 2027! PLEASE READ "CHRIST'S MOST PROFOUND PROPHECY!" WHEN "THE ARCTIC IS ICE FREE!" "STRONG EL NINO COLLAPSE OF THE AMOC & THE 2ND COMING!" "BECOME ONE II!" TRANS HELL! PASSIONATELY LOVE GOD! NOT MONEY! "LOVE OTHERS WITH GOD'S LOVE!" GIVE YOUR WEALTH & LIFE TO GOD! WELCOME TO "THE END OF THE WORLD!" "THANK GOD!" "It Is THE END!" PUTIN STARTS WWIII! 1 "THE FINAL JUDGEMENT" BY 2027! DURING "THE SECOND COMING!" MOST BLESSED - "NORDIC MODEL SUPPORTERS!" THE MOST DAMNED "THE EVIL RICH & RIGHT WING ANTI-CHRISTIANS!" JOE DO "THE SUMMIT TO SAVE OUR SPECIES!" AND "ONE LOVE!" NOW! PREPARE YOUR SOULS - NOW! BECOME "ONE" WITH "THE ONE!" NOW! THE END IS MUCH CLOSER THAN YOU THINK! WHEN I SPEAK - "AS MY FATHER" - I SPEAK - "FOR MY FATHER!" BECOME ONE! - NOW! HIS CHANNEL! LOVE U! MY PRIMARY ROLE IS AS MY CLOSEST SPIRITUAL BROTHER, JOHN THE BAPTIST, TO PREPARE THE WAY! LOVE U! LOVE GOD WITH ALL OF YOUR HEART! DEVOUT YOUR SOUL LIFE & WEALTH TO - “THE GOD OF LOVE!” NOW! NOW! TRY TO LOVE ALL OTHERS WITH GOD’S LOVE! BE OF PEACE! FORGIVE THE WAY YOU WANT TO BE FORGIVEN! PRAY FOR YOUR FORGIVENESS FOR CHOOSING MONEY OVER GOD! INIQUITY OVER EQUITY! FOR NOT SUPPORTING THE ONLY OBVIOUS EGALITARIAN SOCIETIES OF GOD’S LOVE - HELPING “THOSE IN NEED!” THE NORDIC MODEL COUNTRIES! FOR SUPPORTING “THE GREED OF THE FEW!” VERSUS HELPING “THOSE IN NEED!” FOR - NOT BECOMING “ONE WITH - THE ONE!” GOD’S LOVE! Matthew 7:21-23 King James Version 21 Not every one that saith unto me, Lord, Lord, shall enter into the kingdom of heaven; but he that doeth the will of my Father which is in heaven. FATHER’S WILL IS TO HAVE SUSTAINABLE HUMANE AND EGALITARIAN SOCIETIES/MARKETS! ”THE NORDIC MODEL!” AS IT IS IN HEAVEN IT SHOULD BE ON EARTH! 22 Many will say to me in that day, Lord, Lord, have we not prophesied in thy name? and in thy name have cast out devils? and in thy name done many wonderful works? 23 And then will I profess unto them, I never knew you: depart from me, ye that work iniquity. RIGGED! KOCHS TAKE OVER COVID & HEALTHCARE! "ICE FREE ARCTIC!" UNLEASHES "HOT STUFF" "GIGATONS OF METHANE!" CAUSED BY STRONG EL NINO EARTHQUAKES SUPER STORMS AMOC COLLAPSE REDUCED ALBEDO BY 2023-2027! ADD "LATENT HEAT OF FUSION!" = "MELTING OF ANTARCTICA!" JOE DO "THE SUMMIT TO SAVE OUR SPECIES!" AND "ONE LOVE!" OR FRY WHEN YOU DIE! METHANE EXPLODES! IPCC ISSUES NO METHANE NON-SCIENCE! ARCTIC ICE BY GEOENGINEERING!? AMOC COLLAPSE EXPLODES GULF TEMPS! SUPER STORMS DESTROY GULF BY 25! "It Is THE END!" 2030! REMEMBERING - CHENEY BUSH STOLE B-TRILLIONS DOING 9/11! A NEWS WOMAN CALLED BLD 7 DOWN LIVE ON TV! ROCKEFELLER TOLD RUSSO 9/11 WOULD HAPPEN 11 MONTHS BEFORE AND ROCKEFELLER TOLD RUSSO "SATAN'S MAFIA GLOBAL DEPOPULATION AND POLICE STATE AGENDA!" NO VACCINES FOR POOR COUNTRIES IS SATAN'S MAFIA DEPOPULATION AGENDA! It Is THE END! ENJOY HELL! "THANK GOD!" . . "It Is THE END!" . OF . "RUTHLESS RULE BY THE EVIL RICH!" THEIR OPERATORS AND ANTI-CHRISTIAN WHORES! . . OMG! "THE ARCTIC OCEAN" IS . . "ON FIRE!" . . "HOT STUFF!" WILL ARISE ON "TRUMPET COCAINE!" SOON! THE FINAL WARNING TO "SATAN'S STATES OF EVIL GREED!" "SUPPORT THE NORDIC MODEL" & "GIVE TO THOSE IN NEED!" THE NORDIC THEORY OF LOVE - VS - SATAN’S EMPIRE OF EVIL GREED’S THEORY OF “ALL FOR ME!” “FUCK YOU-ISM!” OR "FRY BABY FRY!" SOON! STAND AGAINST THE PURE EVIL INIQUITY OF WEALTH INCOME & JUSTICE IN THE US & GLOBALLY! SEEK - NOT - TO STORE UP WEALTH ON EARTH! BUT IN HEAVEN! RARELY WILL A RICH PERSON ENTER HEAVEN UNLESS THEY GIVE AWAY THEIR INSANE INCOME (BAGS OF HARVEST) AND INSANE WEALTH (HUMPS ON THEIR BACKS) TO “THOSE IN NEED!” FOR THE LOVE OF GOD! WILL THEY FIT THROUGH THE EYE OF THE NEEDLE! HEAVEN! WORTH OVER $5 MILLION? GIFT EXCESS OVER $5 MILLION IN ASSETS AND A $5 MILLION HOUSE PER FAMILY BY 2025! IS YOUR NET WORTH FROM $1 TO $5 MILLION - GIFT 10% OF TOTAL INCOME! UNDER $1 MILLION - WHAT YOU CAN! T0 - “THOSE IN NEED!” STRETCH! SHOW GOD HOW MUCH YOU LOVE GOD! BY SHOWING YOUR LOVE FOR - THOSE IN NEED! YOUR LOVE AND HELP FOR - “THOSE IN NEED” - MAY - “SAVE YOUR SOUL!” SAVE A CHILD IN NEED! GIVE THAT CHILD A GOD / GOOD CENTERED HOME AND UPBRINGING! THE CHILD’S LOVE WILL SAVE YOUR SOUL! DON’T GET TOO MANY CHILDREN! ONE IS GOD! IT IS SIMPLY WHAT - “A GOOD SOUL” - WORTHY OF ETERNITY - ONE IN GOD’S LOVE WOULD DO! BY 2023-2027 IT WILL BE - MAD MAX! RAISE YOUR SPIRITS UP TO GOD! “ASCENSION THURSDAY 2025!” OR SPIRITUALLY MEANINGFUL DAY TO YOU! A NICE SUNSET! GET YOUR SUCK BAGS - NOW! PREPARE YOUR SOUL! PREPARE YOUR FAMILIES! LOVE GOD! GIVE TO & HELP THOSE IN NEED! SUPPORT “THE NORDIC MODEL!” NOW! . . NOW! NARROW IS THE ENTRANCE TO HEAVEN! THE NORDIC MODEL SUPPORTERS! WIDE IS THE GATE TO HELL! THOSE NOT SUPPORTING SUSTAINABLE HUMANE AND EGALITARIAN! MY MAIN GOAL! . . . . “TO SAVE YOU!” LET JESUS, SARAYU AND MAMMA - “THE LOGICAL GOD OF LOVE!” GUIDE YOU HOME! NOW! “GET YOUR SUCK BAGS” NOW! TIME TO “RAISE OUR SPIRITS UP TO GOD!” BY “ASCENSION THURSDAY 2023” AT THE LATEST!

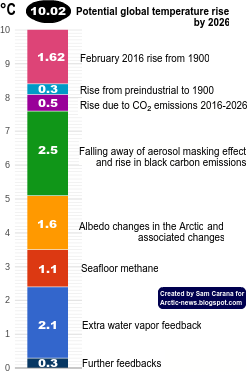

MY MAJOR SCIENTIFIC ARGUMENTS: WITH ONLY A 3-5C RISE IN GLOBAL TEMPS GMAT, ABOVE PRE-INDUSTRIAL TEMPS, 2-3 ABOVE TODAY, CORE SAMPLES BY ANDRILL IN ANTARCTICA PROVED THAT IT CAUSED 60 FEET PLUS SEA LEVEL RISE. ANTARCTICA MELTED 60 TIMES AT THESE TEMPS, WEST AND EAST. PER SAM CARANA 2 C WAS HIT FEB 2020. AN ADDITIONAL 1-3C WILL BE HIT BY 2023-2027! “The last time the Earth experienced a comparable concentration of CO₂ was 3-5 million years ago, when the temperature was 2-3°C warmer and sea level was 10-20 meters (30’ TO 60’) higher than now. But there weren’t 7.7 billion inhabitants,” said WMO Secretary-General Professor Petteri Taalas. 30’-60’ SEA LEVEL RISE BLOWS UP MOST OF THE 440 NUCLEAR REACTORS! DUE TO “THE REDUCTION IN GLOBAL DIMMING” - CAUSED BY DR DEATH’S KILLER COVID! CAUSING A COLLAPSE IN GLOBAL ECONOMIES! “HOT STUFF” “THE CLATHRATE GUN FIRING ON TRUMPET COCAINE” WILL HAPPEN BY 2025! DUE TO “COMPLETELY ICE FREE ARCTIC” BY 9/2023-9/2027! “MASSIVE RELEASES OF SIBERIAN METHANE” WILL CAUSE 2-3C RISE IN GMAT BY 2025-27! MELTING ANTARCTICA WEST & EAST RAPIDLY! CAUSING 60’ SEA LEVEL RISE BY 2025-2030! THIS DESTROYS MOST OF THE 440 NUCLEAR REACTORS. GAME OVER “It Is THE END!” HENCE MY PROPOSAL FOR 350-400’ PYRAMID STRUCTURES AROUND NUCLEAR REACTORS, SINCE WATCHING THE ANDRILL VIDEO 2017. ALONG WITH “SIBERIAN METHANE CAPS” TO SEQUESTER METHANE! STORING IT IN TANKS! “THE MONSTER SUPER STORMS” AND STORM SURGE MAY DESTROY NUCLEAR REACTORS, SOONER THAN SEA LEVEL RISE. BY 2025 THE GULF & FLORIDA WILL BE DESTROYED BY “THE MONSTER SUPER STORMS” - EXIT NOW! THIS IS “HERD GENOCIDE“ - NOT - “HERD IMMUNITY!“ THIS IS THE GLOBAL DEPOPULATION AND POLICE STATE AGENDA! “It Is THE END!” BY 2030-2040! “HERD GENOCIDE!” NOT “HERD IMMUNITY!” PART II. Americans Are Dying At Rates Far Higher Than Other Countries! 8 MILLION MORE POOR! “HERD GENOCIDE III” COVID LONG-HAULERS! ACCELERATES “GLOBAL DIMMING!” CAUSING “ICE FREE ARCTIC!” 9/2022 UNLEASHING “HOT STUFF!” MELTING ANTARCTICA! GMAT 2-3C RISE = 60’ SEA LEVEL RISE 2025-30! BLOWING UP 440 NUCLEAR REACTORS! “THE END!” MY PRAYER FOR - “THE REST” - SUPPORTING - “THE EVIL RICH!” CHRIST’S COMMANDS US TO - COMMAND THE RICH TO “TAKE CARE OF THOSE IN NEED!” TO ENTER HEAVEN! MY INSPIRATIONS OF WHAT YOU MUST DO IN TODAY’S TERMS - TO ENTER GOD’S HEAVEN! MOVE TO - CANADA - NOW! IF YOU CAN! BANF TO LAKE SUPERIOR UP TO HUDSON BAY, EAST. NORDIC COUNTRIES. NEW ZEALAND IF YOU CAN AFFORD TO. LAKE TAHOE, LAKE CHAMPLAIN, GREAT LAKES EAST TO COAST IN US! MUCH OF MY WORK IS IN ALL CAPITALS - most of others works are in non-caps. Sources are linked - blue text. POSTS TO RAISE YOUR SPIRIT UP TO GOD HUMANELY: GUYMCPHERSON.COM MAXDOGBREWING.COM PEACEFUL PILL HANDBOOK.COM SUICIDE.ORG DUE TO - “THE LATENT HEAT EFFECT!” - UNLEASHING - “HOT STUFF!” I COMPARE MY FORECAST FOR EXTINCTION TO SAM’S AND GUYS!!” CAUSING GMAT TO RISE BY 18 C / 32.4 F BY 2026 ACCORDING TO SAM CARANA!

LOTS OF VIDEOS - TAKES TIME TO LOAD! New Topic /Videos Each Post Plus Key Videos ALL CREDIT FOR TRUTH IS TO - "THE ONE" - THE SUNSHINE BAND AND AUTHORS NOTED. MY CREDIT IS FOR ANY MISTAKES! SORRY! THE NORDIC MODEL & The Final Judgement: Take Care of "Those in Need!" Or Fry in Hell! Christ IS "The First Great SOCIALIST!" Last Warning! SUPPORT THE NORDIC MODEL or FRY Baby FRY! WHEN YOU DIE, BABY, DIE! SOON!

GLOBAL POLICIES TO SAVE THE SPECIES: ONE LOVE CLIMATE REFUGEES & PRISON COMMUNITIES ENCASE NUCLEAR REACTORS - ENCASE POWER POLES - CAP SIBERIAN AND ARCTIC METHANE - TRANSITION TO PRIMARILY SOLAR AND WIND - USING THE SAVE THE SPECIES - NON-DEBT BASED CURRENCY! EFFECTIVELY A NORDIC MODEL / RESOURCE BASED GLOBAL RENEWABLE ENERGY ECONOMY! - NOW! ALL POSTS (clickie) TOP POSTS: "THE LOGIC OF THE GOD OF LOVE!" MEDICARE FOR ALL - CHRISTIAN! CAPITALISM - EVIL! DO YOU CHOOSE - MONEY OR GOD! "MY HIS STORY" ANTARCTICA MELTING RAPIDLY! ANDRILL 2016 VIDEO - 60-75 FOOT SEA LEVEL RISE WITH 400 PPM CARBON, SAME AS TODAY, AND JUST SLIGHTLY HIGHER TEMPS THAN TODAY! "LIVING GIVING NETWORKS:" THE THEISTIC HUMANISTIC MODEL FOR ACHIEVING -"ONENESS" - WITH - "GOD'S LAW" - TO TAKE CARE OF - "THOSE IN NEED!" TO ACHIEVE "THE SHE MATRIARCAL NORDIC MODEL!" (not a business solicitation) "BECOMING ONE" CORONAVIRUS HELL ON EARTH! THEN - "HOT STUFF"- IS UNLEASHED! EXIT - THE GULF & FLORIDA - NOW! “THE MONSTER SUPER STORMS” WILL DESTROY THEM . . . . BY 2025! OMG! "GET YOUR SUCK BAGS" NOW! "THE HAMMER AND THE DANCE!" THE MOST HORRIFIC CASE. . . . . "It Is THE END!" WORLD'S ONLY MAJOR TERRORISTS GROUP! THE EVIL RIGHT WING! "AS IT IS IN HEAVEN - SO SHOULD IT BE ON EARTH!" SUPPORT THE ONLY CHRIST LIKE SOCIETY OR FRY IN THE HELL YOU SUPPORT! RIGGED - The GREAT SIBERIAN METHANE COVER UP! CAN "THEY" FIX IT? STOP HELL ON EARTH? "HOT STUFF LIVES?" The Clathrate Gun Fired FOR FULL SCREEN: Login to Youtube FIRST, then Open My Site, Then Click on Video you Want Full Screen. Now Go To Youtube, Switch Screens, Click on History, the First Is the Video You Clicked On - On My Site! If NOT close All, Repeat Process. MUST READ and WATCH The Nordic Theory of Everything / Love, and Anu Partanen’s writings Viking Economics: How the Scandinavians Got It Right - And How We Can, Too; The Secrets of The Nordic Model, by the same author, and The Nordic Perspective! US CORPORATE STATE SOCIALISM, Fascist Monopolistic, Homo and Transphobe, Racist, Kleptocratic / Thieves, Oil War Imperialist Focused, "ALL for THE RICH" - - "RAPE THE REST!" Especially Destroy the Lives of the Truly Good People Who Stand against THE EVIL GREED of THE FEW, The Sunshine Band. UNTIL The Horrific Demise of ALL God's Children, God's Species and Wonder Filled World for THE EVIL GREED OF THE FEW . . . . . . . . is EVIL! THE NORDIC MODEL: Libertarian Democratic Market Socialism: Denmark, Finland, Norway, Sweden, are Sustainable, Humane and Egalitarian (Think - SHE - The Matriarcal Nordic Model). . . . . . .it is GOOD! Vote for THE MATRIARCAL NORDIC MODEL - NOW! Jill Stein, Bernie Sanders, Alexandria Ocasio-Cortez - AOC, and The Squad 2024! VOTE! MY HEROS OF "THE MATRIARCAL NORDIC MODEL!" BELOW BERNIE SANDERS AND ALEXANDRIA CORTEZ 2020! IF NOT, JILL STEIN AND ABBY MARTIN - GREEN PARTY - 2020! "God's Girls!" "GG's Community," God's Gifted, think "The Beatitudes," is the Amazing Arts Colony We Will Be playing, singing, praising, loving, adoring God at Soon! Think billions of souls coming to see you, millions daily! Loving U!

MY HEROS, ABOVE:

LESTER BROWN, "WORLD ON THE EDGE," "PLAN B 4.0," EARTH-POLICY.ORG DR. GUY MCPHERSON, FATHER OF "ABRUPT CLIMATE CHANGE" DR. JORGEN RANDERS, FATHER OF "THE LIMITS TO GROWTH!" AND, "2052: A Global Forecast for the next 40 Years!" MICHAEL MOORE - DOCUMENTARIAN - FOR - "JC AND THE SUNSHINE BAND!" EXCEPTIONAL DOCUMENTARIES! RICK STEVES - THE NORDIC MODEL - THE GOOD LIFE! POSTER CHILDREN, BELOW: EVIL TRUMP! OF "THANK GOD!" - - "It Is THE END!" "HOT STUFF!" "THE SIBERIAN METHANE MONSTER!" "House of Trump, House of Putin: The Untold Story of Donald Trump and the Russian Mafia"

“Damning in its accumulation of detail, terrifying in its depiction of the pure evil of those Trump chose to do business with.”--The Spectator (UK) Watch "THE SIBERIAN METHANE MONSTER" - ABOVE - BURN UP and SUPER STORMS DESTROY Planet EVIL GREED! DAILY! OH BOY, WHAT COULD BE MORE EXCITING THAN THAT!? OK, Her Name is . . . . . . . "HOT STUFF!"

"The Limits to Growth: A Final Warning" tells you about the authors work since the early seventies, my work since 1980, and the stage of the "science of overpopulation analysis." Dr. Jorgen Randers, "2052: A Global Forecast for the Next Forty Years," and Lester Brown, "World on The Edge," have portended the fate of the world, due to overpopulation since the seventies! However limited I see their understanding of "abrupt climate change." Archives

July 2024

Categories |

||||||||||

RSS Feed

RSS Feed