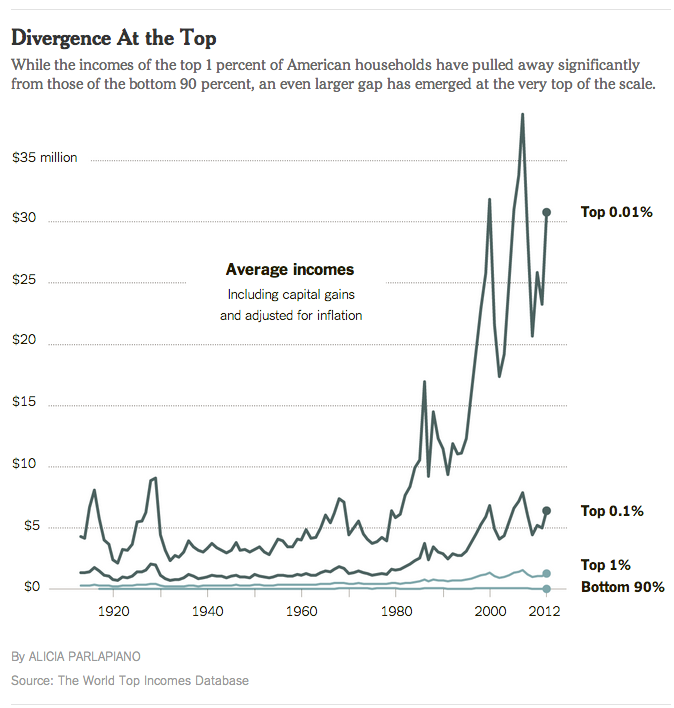

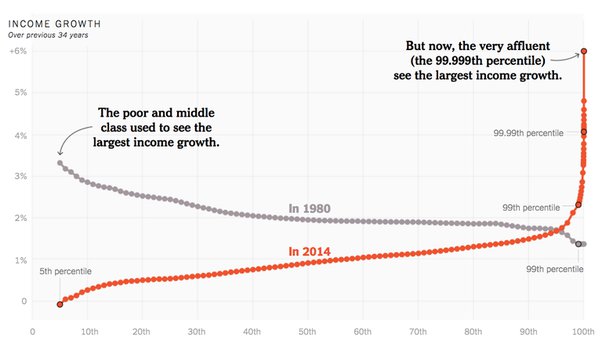

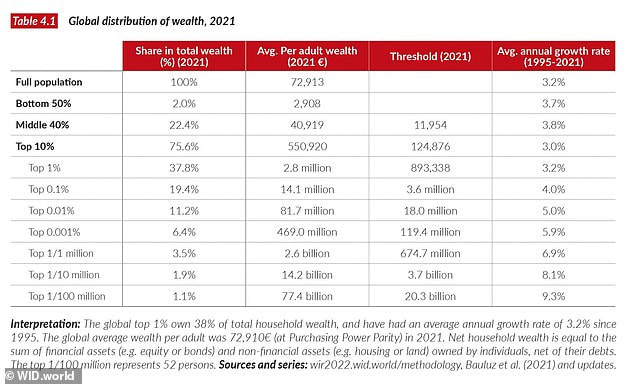

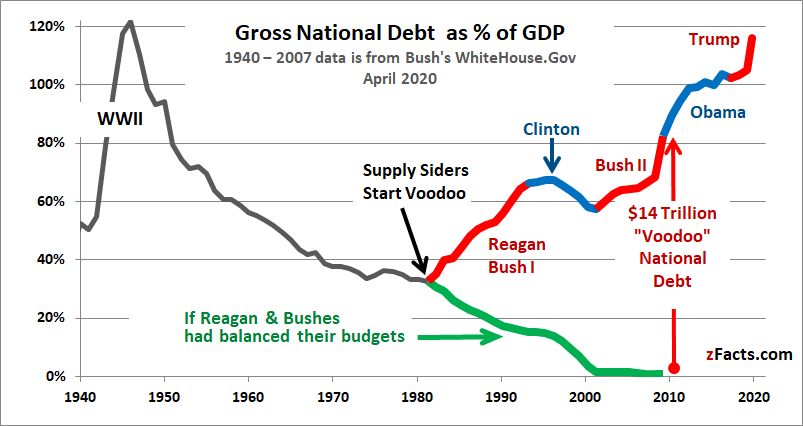

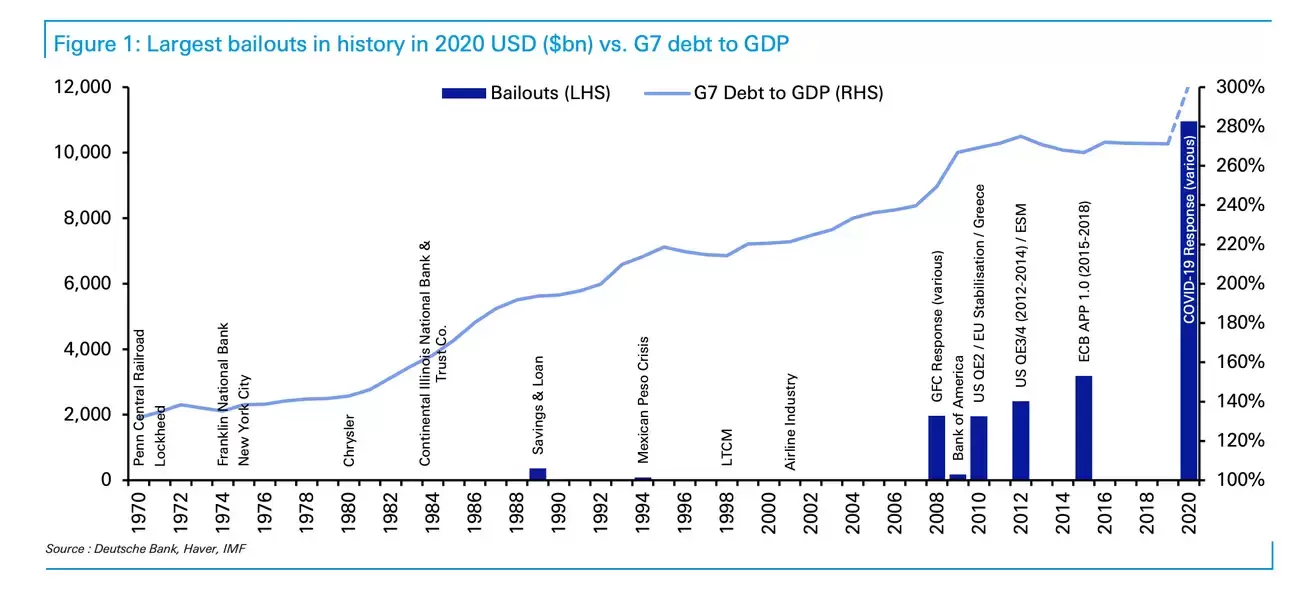

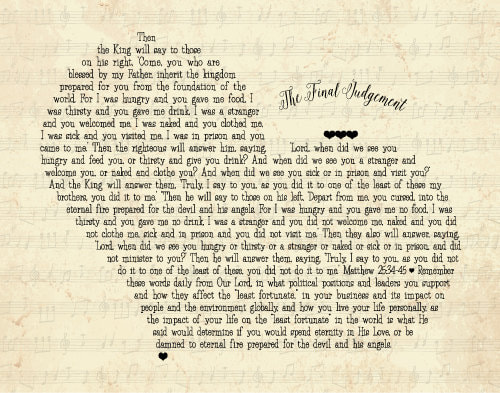

REALLY PONDER THE GRAPHS BELOW! THE "DIVERGENCE AT THE TOP" IS PROOF THAT "THE MASTERS OF THE UNIVERSE," THE RICH AND POWERFUL, STILL ARE LIVING BY "THE VEIL MAXUM" OF "THE MASTERS OF THE UNIVERSE," "ALL . . FOR US!" "NONE . . FOR THE REST!" WHAT THE FOUNDER OF CAPITALISM, ADAM SMITH, STATED WOULD SIGNAL "THE FAILURE OF CAPITALISM!" THE BOTTOM 90% HAVE MADE STATISTICALLY MEANINGLESS GAINS SENSE THE 1920'S! EVEN THE TOP 1% HAVE MADE LIMITED GAINS. ONLY THE SUPER RICH, THE TOP 1/100 OF 1%, THE 0.01%, HAVE MADE SIGNIFICANT GAINS! THE REALITY IS MUCH MUCH MORE INIQUITY OF INCOME, WEALTH & INJUSTICE THAN THESE GRAPHS DEPICT, AS MOST OF THE WEALTH OF THE TOP 1/100 OF 1%, 1% OF 1%, THE 0.01%, IS HELD OFFSHORE, AND NOT ACCOUNTED FOR IN ANY DATA OR STATISTICS! FURTHER, NOT ACCOUNTED FOR IS THE ABILITY OF "THE SUPER RICH" TO HIDE ALL OF THEIR ASSETS IN "SHELL GAMES" IN OFFSHORE ACCOUNTS, TO NOT ONLY AVOID TAXES, BUT ALSO, CREDITOR LIABILITIES. "ALL FOR THE SUPER RICH!" "NOTHING FOR THE REST!" THE TAX CUTS FOR THE SUPER RICH HAVE CAUSED ALMOST ALL OF THE DEBT OF THE US GOVERNMENT THAT IS A BURDEN OF ALL OF US! THE EVIL RUTHLESS SUPER RICH HAVE FLEECED ALL OF THE GAINS. DUMPING ALL OF THEIR LOSSES ON "THE REST!" IN TRILLIONS OF DOLLARS OF BAILOUT FUNDS, THAT HAVE MOSTLY GONE TO THE SUPER RICH, THE TOP 1/100 OF 1%, THE 0.01%! ALL I CAN CONTINUE TO THINK, IS GOD SAYING TO THE RICH! . . "DEPART FROM ME!" "YE THAT HAVE WORKED THE MOST EXTREME INIQUITY OF INCOME, WEALTH AND JUSTICE, OF ANY SOCIETY ANY TIME IN WORLD HISTORY!" . . ENJOY THE VERY HELL OF ALL HELLS YOUR EVIL GREED CAUSED! . . THE RICH, THEIR OPERATORS AND PUPPETS! "YE THAT WORK INIQUITY!" "DEPART FROM ME" INTO THE FIRES OF HELL MADE FOR THE DEVIL AND HIS ANGELS! Failed Bailout Investments Below is a list of all companies that failed to repay their bailout money. These transactions are final and will never result in a profit for taxpayers. https://projects.propublica.org/bailout/list/losses Investments that might still turn a profit are not listed here. Also not listed here are recipients of aid through TARP’s housing programs (like mortgage servicers and state housing orgs), since they received subsidies that were never intended to be repaid. Bailout Recipients (Detailed View) We're tracking where taxpayer money has gone in the ongoing bailout of the financial system. Our database accounts for both the broader $700 billion bill and the separate bailout of Fannie Mae and Freddie Mac. https://projects.propublica.org/bailout/list/simple For each entity, we provide a “Net Outstanding” amount, which shows how deep taxpayers are in the hole after accounting for any revenue the government has received (usually through interest or dividends). Companies that failed to repay the government and resulted in a loss are shaded red. You can see a list of those investments here. All other investments either returned a profit to the government or might still be repaid. Recipients of aid through TARP’s housing programs (such as mortgage servicers and state housing orgs) received subsidies that were never intended to be repaid, so we don’t mark those as losses.. Note: Subsidies are listed separately from the investment programs. So, for instance, Bank of America is listed twice – both as a mortgage servicerand as a bank. DIVERGENCE AT THE TOP! . . IS TRULY EVIL! . . BUT DOES NOT INCLUDE ASSETS HELD IN OFFSHORE ACCOUNTS, MOST OF THE WEALTH OF THE SUPER RICH. PLUS THE GRAPH DOES NOT INCLUDE THE MANY TAX CUTS FROM 2012 ON, NOTABLY TRUMP'S TAX CUTS IN 2017! PLUS NOT INCLUDED ARE THE GAINS FROM RECEIVING MOST OF THE GOVERNMENT BAILOUT FUNDS, AND GOVERNMENT FUNDING FOR THE MILITARY INDUSTRIAL COMPLEX, TO STEAL EVERYTHING FROM EVERYONE GLOBALLY, MILITARY IMPERIALISM! NOR DOES IT INCLUDE THE SLASHING OF SOCIAL PROGRAMS AND EDUCATIONAL FUNDING FOR THE REST BY THE RIGHT WING ANTI-CHRISTIAN SATAN'S MAFIA DONS & THEIR OPERATORS AND PUPPETS! HENCE WHY CHRIST SAID . . "I NEVER KNEW YOU! . . DEPART FROM ME! . . YE THAT WORK THE MOST INEQUITABLE INCOME, WEALTH & INJUSTICE EVER! IN ALL COUNTRIES IN EVERY TIME PERIOD!" . . THE RIGHT / RICH ARE PURE EVIL! ‘No Lessons Have Been Learned.’ Why the Trillion-Dollar Coronavirus Bailout Benefited the Rich BY ALANA ABRAMSON JUNE 18, 2020 4:13 PM EDT When Congress passed the $2.2 trillion dollar Coronavirus Aid, Relief, and Economic Security Act (CARES) in late March, lawmakers were quick to tout its egalitarian guardrails. Unlike the 2008 bailout packages, which funneled hundreds of billions to Wall Street and padded executives already-cushy pay packages, the CARES Act was shot through with provisions that lawmakers said would ensure that federal funds actually went to those in need. Any money loaned through the new $500 billion Federal Reserve program, for example, came with oversight measures, limits on stock buybacks and caps on executive compensation. But nearly three months after the CARES Act’s passage, none of those guardrails appear to have made much of a difference. The disbursement of the money so far has been riddled with complaints and analyses showing it has disproportionately gone to the wealthiest corporations and individuals. “No lessons have been learned [from the 2008 bailout]—it certainly seems that way,” says Neil Barofsky, who oversaw the Troubled Asset Relief Program as Inspector General under the Obama administration. Those much-talked-about guardrails that lawmakers imposed on the $500 billion Federal Reserve program, for example, have been mostly irrelevant so far. By June 17, the Treasury had committed to spending just $222 billion, less than half of the funds it was allocated. The rest of the roughly $1.7 trillion allotted through the CARES Act was not, for the most part, subject to the same restrictions. TIME’s analysis of just three pots of money allocated in the CARES Act—the programs buttressing small businesses, healthcare organizations, and institutions of higher education—indicates that the inequitable distribution was of a myriad legislative and regulatory design flaws. While lawmakers included language in the law that explicitly directed funds to those most in need, they often designed programs that were not set up to carry out those intentions. “The safeguards in place are certainly not foolproof,” says Philip Mattera, Research Director at Good Jobs First, a non-profit organization tracking the recipients of the CARES Act. While few dispute that an ambitious federal bailout package was necessary to help the country confront dueling economic and public health crises, it’s clear now that Congress’s massive outlay of cash has been often inefficient, helping to exacerbate the already-yawning wealth gap in the United States while leaving the neediest in the lurch during the worst unemployment crisis since the Great Depression. This package, devised and promoted as a mechanism to alleviate inequitable suffering during the pandemic, may end up playing a role in exacerbating it in the immediate future. “All of this is going to tilt towards the biggest and most established companies and the smaller businesses and regular people are going to get left behind,” says Barofsky. “Because that’s what always happens.” Small, minority-owned businesses struggled to access the Paycheck Protection Program The Paycheck Protection Program (PPP) has become one of the most heavily scrutinized components of the CARES Act. It was the first program to launch and has spent the most money. It has also become a case study in the ways in which the law has fallen woefully short in distributing relief equitably. The concept of PPP itself earned broad praise: the program was designed to offer small businesses federally-backed loans that would transform into grants (that do not have to be paid back), so long as the majority of the funds were used to keep workers on payroll. But the implementation of the program, says John Arensmeyer, the CEO of the Small Business Majority, an advocacy group that represents more than 65,000 independent companies, was structurally flawed. Because PPP required banks to act as intermediaries, it created a dynamic wherein larger, more established companies—often with existing relationships and lines of credit with banks—received funds before smaller operations, who feared their collapse was imminent. “We never felt that running it through banks as intermediaries was the way to go,” says Arensmeyer. “We really felt the larger grant program would be more effective.” The law’s definitions were also problematic. While PPP defined “small businesses” as entities with up to 500 employees, the law included a provision pertaining to the food and hospitality sectors wherein companies with individual locations of fewer than 500 people were still eligible. That meant that large, multi-million dollar chains, like Ruth’s Chris Steakhouse and Shake Shack were able to apply, often edging out the smaller mom-and-pop enterprises that the law was touted as propping up. (Both Ruth’s Chris and Shake Shack returned their loans after a wave of public criticism.) Finally, lawmakers failed to allocate even close to enough money to meet small businesses’ needs. When PPP first launched on April 3, the $350 billion fund was depleted within two weeks. The limited supply meant that small-business owners like Tara Williams-Harrington, who owns a Newark franchise of Bricks 4 Kidz, which holds various classes for children using LEGO® bricks, were shut out of the first round. (Williams-Harrington received a loan in May, after Congress allocated more money to PPP.) In a controversial move, the Treasury Department has refused to release recipients of the program, making it impossible to fully assess which enterprises benefitted most. But independent analyses indicate that the smallest companies, and particularly minority-owned shops, were the least likely to receive PPP funds. A survey of African-American and Latinx workers conducted by the Global Strategy Group released May 13—after the second round of funding—found that just 12 percent of workers received the assistancethey requested. A later survey from Arensmeyer’s group showed that, while 63 percent of Black and Latino small business owners sought and received financing, three in 10 did not receive the amount they requested. The program “is a reflection of the inequity that already existed and that’s playing out in a crisis situation,” Arensmeyer says. While many of the businesses that received help needed it, he adds, the way the funds were distributed was unfair. “The fact [is] that it left more underserved businesses behind, that has widened that gap.” This outcome, lawmakers say, was not their intention. The CARES Act specifies that lenders prioritize underserved markets, including female and minority owned businesses. The problem is that there was neither an enforcement mechanism nor a system of incentives to ensure that banks actually prioritized such businesses. A May 8 report by the Inspector General for the Small Business Administration found that the organization did not comply with this guidance. As a result, the Inspector General wrote, “these borrowers, including rural, minority and women owned businesses, may not have received the loans as intended.” Barofsky says this scenario was a classic example of Washington repeating past mistakes. “We learned from [2008] that when you rely on private institutions such as banks to carry out public policy it’s not going to happen unless you build in requirements and incentives,” he explained, noting that TARP implemented similar provisions for homeowners, only to see those efforts fall short. “Rather than learn that lesson…Treasury and SBA really just ignored it and thats one of the reasons the program rolled out the way it did.” The wealthiest universities were eligible for the most aid—leaving community colleges in the lurch. The CARES Act directed $14 billion in grants to universities and other institutions of higher learning, the majority of which—$12.5 billion—went towards colleges and universities to assist with student financial aid. Institutions that received federal funding were required to spend at least 50% on students; the remainder could be used to reduce pandemic-related costs. But so far, most students have yet to receive a windfall, in part because — like PPP — the program was structurally flawed. In this case, one major problem was the formula, determined by Congress, dictating how the Department of Education disburse the funds. The formula relied on the number of full-time Pell Grant recipients physically on campus prior to the pandemic. While that data point sounded good on paper, it had the effect of disproportionately rewarding wealthier institutions, which tend to have more full-time students and graduate students than poorer institutions like community colleges, says Ben Miller, a postsecondary education expert at the progressive think tank Center for American Progress. “A majority of students at community colleges are part time,” Miller says. “So when the calculation uses full time equivalent enrollment, that substantially shrinks the enrollment in community colleges which mean they receive fewer dollars.” New York University, for instance, which in 2017 had a $4 billion dollar endowment, received $25.6 million from the CARES Act—more than every CUNY community college except for the Manhattan campus. Both Harvard and Yale Universities were slated to receive nearly $9 million and $7 million, respectively. Both Ivy League institutions declined to accept the funds after a public backlash. But their refusal leaves the Department of Education in a bind. “Given how Congress wrote the law, we are currently assessing our options for redirecting this money that goes either unclaimed or returned by institutions,” Angela Morabito, a spokeswoman for the Department of Education, said in a statement to TIME. The funds that Harvard and Yale refused have yet to be reallocated. On May 15, House Democrats passed a bill that would amend the formula, distributing funds by total headcount, rather than full time enrollment. The bill as a whole has virtually no chance of passing the Republican-led Senate, although the fate of that individual provision is unclear. Other critics point at Education Secretary Betsy DeVos’s April guidance, which decreed that certain students, including recipients of the Deferred Action for Childhood Arrivals Program (DACA) were ineligible for aid. (The California community college system is currently suing DeVos over this matter.) Hospitals serving wealthier patients got more aid than those serving the poor The CARES Act allocated $175 billion to the Department of Health and Human Services to help prop up hospitals and health care providers, but that program, like the one designed to serve students, relied on a flawed formula. In this case, the formula was determined by HHS, not Congress. But it still resulted in unintended outcomes, says Colleen Meiman, a policy adviser at the National Association for Community Health Centers who previously worked at HHS. Because the formula relied on net patient revenue, it meant that wealthier hospitals, where patients are more likely covered by private insurance, received more funds than community health centers and hospitals in poor regions, where patients are more likely to be on Medicaid. A May 13 Kaiser Foundation study found that hospitals with the lowest share of revenue from private insurance received half as much per hospital bed as their counterparts with the highest share. “All things being equal,” the study found, “hospitals with more market power can command higher reimbursement rates from private insurers and therefore received a larger share of the grant funds under the formula HHS used.” The fund set aside $10 billion for hospitals and health centers in rural areas, but the results were perverse: community health centers, particularly larger outposts in urban areas hit hard by COVID, like New York City, that were ineligible for other programs like the PPP, were less likely to receive federal aide than wealthy hospitals in places where the rate of infection was lower. Meiman, who says she has been in frequent touch with HHS voicing her concerns over formula, says she’d perplexed that nothing has changed. “Its HHS’s responsibility to look at these discrepancies and try and even them out. I’m frustrated.” An HHS spokesperson said a “number of approaches” were considered, and these were adapted after consultations across both the department and broader presidential administration. Most hospitals nationwide stopped elective surgeries—a significant source of revenue—to handle COVID patients. But Karyn Schwartz, a senior fellow at Kaiser who wrote the study, notes they were the ones “ probably better positioned to absorb some of the shock from coronavirus” than those that received less funding. On June 9, after facing pressure from lawmakers on both sides of the aisle, HHS announced an additional $25 billion will be distributed to healthcare organizations, with a priority on providers that either did not receive funds in the initial round or serve a disproportionate number of patients reliant on Medicaid. But Meiman says that doesn’t fix the problem. The eligibility requirements mean community health centers, particularly those who already received funds, “won’t get a penny,” she says. “I cant tell you how many phone calls I got from health centers saying, ‘They are going to give us some funding finally,'” Meiman says, “And I had to say, I’m very sorry but read the fine print. You’re not eligible for any of this.” Hundreds of billions have yet to be disbursed! Almost three months after President Trump signed the CARES Act into law, some of the most anticipated programs are finally getting off the ground. On June 15, Treasury Secretary Steve Mnuchin announced lenders could begin registering for the Main Street Lending Program (MSLP). Like PPP, the MSLP will administer federally-backed loans, but expands the eligibility requirements to encompass businesses with up to 15,000 employees or $5 billion in revenue. (Unlike PPP, the loans are not forgivable). While the program is not yet operational, the use of banks as intermediaries could potentially mean a repeat of the anger that surrounded PPP recipients. “Once you start getting into the ideas of awards without formulas, lobbying and influence comes into play,” says Mattera, who is tracking the money for the Good Jobs First project. Democrats are already taking issue with several MSLP provisions, including one that allows companies that have already laid off or furloughed workers to apply for MSLP, and another that fails to require that companies keep workers on payroll to receive the federal funds. (According to the latest Federal Reserve guidance, companies must only demonstrate a “commercially reasonable” and “good-faith effort” to keep payroll intact.) What’s clear now is that neither the pandemic itself nor the economic recession will be short-lived. And as the debate over another relief package to combat these woes intensifies in Washington, the inequitably disbursement of cash in the first round could soon take center stage.

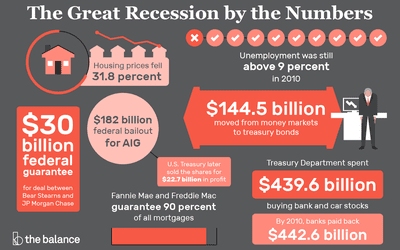

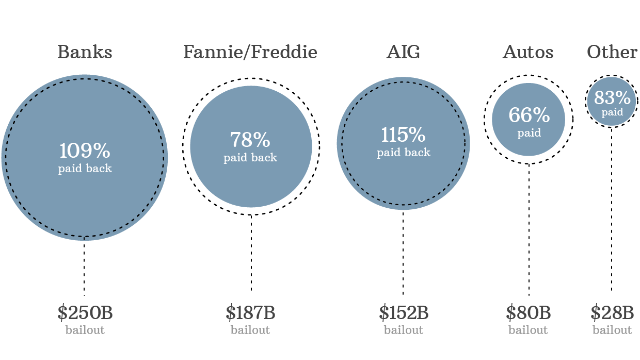

A History of U.S. Government Financial Bailouts By MARC DAVIS Full Bio https://www.investopedia.com/articles/economics/08/government-financial-bailout.asp Marc Davis is the author of several books and has 20+ years of experience writing about business, finance, and economics. Learn about our editorial policies Updated August 11, 2023 Reviewed by CHARLES POTTERS Fact checked by JIWON MA The U.S. government has a long history of leading economic bailouts. The first major intervention occurred during the Panic of 1792 when Treasury SecretaryAlexander Hamilton authorized purchases to prevent the collapse of the securities market.1 Federal Reserve History. “The First Bank of the United States.” When private enterprises are in need of rescue, the government is often ready to prevent their ruin. In this article, we look at six instances over the past century that have necessitated government intervention:

KEY TAKEAWAYS

The Great Depression The Great Depression is the name given to the prolonged economic decline and stagnation precipitated by the stock market crash of 1929. Following the election of President Franklin D. Roosevelt in 1933, the government enacted a number of precedent-setting rescue programs designed to provide relief to the nation's people and businesses.2 When Roosevelt took office, the unemployment rate neared 25%.3 Countless Americans who lost their jobs also lost their homes. The population experiencing homelessness grew, especially in urban areas. To keep people in their homes, the government created the Home Owners' Loan Corporation, which bought defaulted mortgages from banks and refinanced them at lower rates. The program helped one million families benefit from lower rates on refinanced mortgages.4 Because there was no secondary market, the government held the mortgages until they were paid off. Government-Backed Programs The government created a number of other programs to help the nation weather the Great Depression. While these initiatives were not bailouts, strictly speaking, they provided money and support to create tens of thousands of new jobs, principally in public works. Some of these projects included:

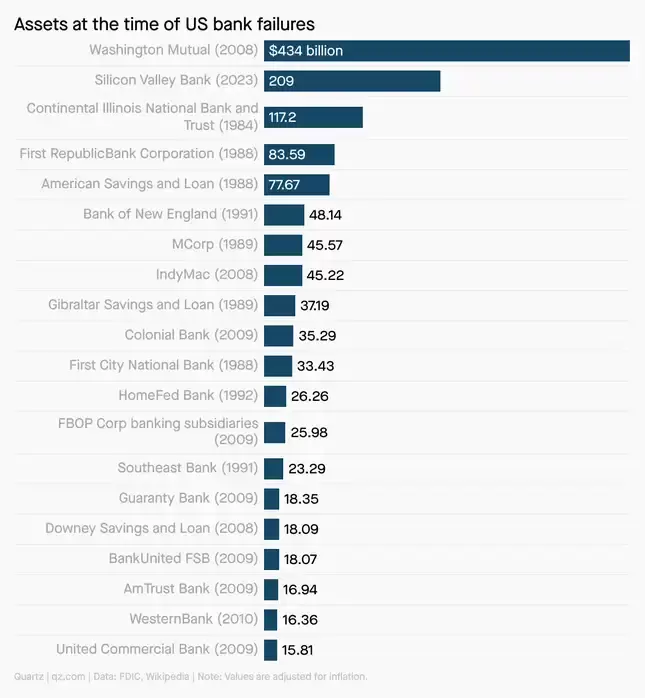

Armed with a steady income, millions of re-employed workers began purchasing again and the economy recovered slowly. By 1939, as World War II broke out in Europe, the Great Depression was beginning to loosen its grip on the economy.11 When the U.S. entered the war after the bombing of Pearl Harbor in 1941, the great economic recovery was already underway, and it would culminate in the post-war boom of the 1950s.12 The Savings and Loan Bailout of 1989 Savings & Loan institutions (S&Ls) were originally created to provide mortgages to homeowners and helped spur the housing boom that followed the end of World War II. S&Ls usually paid a higher interest rate on deposits than commercial banks and offered premiums and gifts to attract depositors.13 Flush with funds, numerous S&Ls ventured into risky and ill-advised commercial real estate ventures. Also, rising interest rates meant S&Ls were paying more interest on deposits than what they collected on fixed-rate loans. Many were insolvent by the early 1980s, but customers kept banking with them because they knew their deposits were insured. In addition, regulators allowed zombie banks to continue operating in hopes they would eventually return to profitability.14 By 1986, approximately 1,000 S&Ls that were still in operation were insolvent or nearly insolvent.15 Loan defaults ran into the billions, and billions more were spent to cover federally insured deposits. Congress took several measures to address the crisis, such as passing the Financial Institutions Reform, Recovery and Enforcement Act of 1989 and creating the Resolution Trust Corporation to sell off assets. Between 1986 and 1995, the government spent an estimated $160 billion (in 1990 dollars) cleaning up the savings and loan mess.16 Bank Rescue of 2008, or the Great Recession The 2007-08 Financial Crisis resulted in an unprecedented federal intervention to rescue banks and restore confidence to the finance sector. The chief culprit in the crisis was the implosion of mortgage-backed securities (MBS) and the collapse of the housing market that threatened many companies with insolvency. In the early days of the crisis, no one knew which companies were holding toxic assets and who would be next to falter. Lack of trust spread, with market participants unwilling to take on counterparty risk. As a result, companies were prevented from accessing credit to meet their liquidity needs. To address the crisis, Congress passed the Emergency Economic Stabilization Act of 2008. The act created the Troubled Asset Relief Program (TARP), which authorized the U.S. Department of the Treasury to buy up to $700 billion in toxic assets from companies, which could then replenish their balance sheets with safer assets.17 The Treasury Department was also authorized to buy up to $250 billion in bank shares, which would provide much-needed capital to financial institutions.18It bought $20 billion in shares each from Bank of America (BAC) and Citigroup (C). The Treasury Department later sold those shares back for a profit. In total, the government provided $245.1 billion in TARP assistance to banks and recouped $275.6 billion, for an investment gain of $30.5 billion.19 Fannie Mae and Freddie Mac The implosion of the housing market also brought trouble to Fannie Mae and Freddie Mac, two government-sponsored enterprises charged with promoting homeownership by providing liquidity to the housing market. Fannie and Freddie play a vital role in the housing market by purchasing mortgages from lenders and guaranteeing loans. Congress authorized the creation of Fannie Mae during the Great Depression and Freddie Mac in 1970.20 In 2008, at the height of the financial crisis, Fannie and Freddie held obligations on $1.2 trillion in bonds and $3.7 trillion in mortgage-backed securities. Deterioration in their finances meant neither could service their obligations2122 This forced the Federal Housing Finance Agency (FHFA), which regulates Fannie and Freddie, to put both into conservatorship.23 To keep both solvent, the Treasury Department provided $119.8 billion to Fannie Mae and $71.7 billion to Freddie Mac in exchange for senior preferred stock. This required Fannie and Freddie to pay dividends to the government ahead of all other shareholders.24 As of 2020, Fannie Mae has paid $181.4 billion in dividends to the Treasury Department, while Freddie Mac has paid $119.7 billion.25 The lifeline extended by the Treasury Department gave both time to clean up their finances. The two reported losses between 2007 and 2011, returning to profitability in 2012.26 In 2022, Fannie Mae reported $12.9 billion in earnings, while Freddie Mac reported $9.3 billion.2728 Bear Stearns Mortgage-related losses took their toll on Bear Stearns, prompting the Federal Reserve to step in to prevent its collapse in 2008. Bear Stearns—like Bank of America, Citigroup, and AIG—was deemed too big to fail. Its collapse, it was feared, posed systemic risks to the market. The Federal Reserve brokered a merger between Bear Stearns and JPMorgan Chase. To facilitate the deal, the Fed provided a $12.9 billion bridge loan, which was repaid with interest.29 The Fed then lent $28.82 billion to a Delaware corporation created to buy financial assets from Bear Stearns.30 This corporation, Maiden Lane I, then repaid the Fed interest and principal using proceeds from the sale of those assets. By November 2012, Maiden Lane I had repaid the principal and $765 million in accrued interest to the Fed. Maiden Lane I still held $1.7 billion in assets as of December 2014, which would generate gains for the Fed once they are sold or mature.31 The American International Group (AIG) During the financial crisis, the government took control of American International Group (AIG) to prevent the fifth-largest insurer in the world from going bankrupt. AIG had faced steep derivative losses, and the Federal Reserve was worried its failure could severely disrupt financial markets. The Federal Reserve and Treasury Department provided $141.8 billion in assistance in exchange for receiving 92% ownership of the company.32 The government earned a $23.1 billion profit as a result of the bailout. AIG paid $18.1 billion in interest, dividends, and capital gains to the Fed. In addition, the Treasury netted $17.55 billion in capital gains. However, about $12.5 billion in assistance provided under TARP was not recovered, resulting in a net gain of $23.1 billion for the government.33 The COVID-19 Pandemic Perhaps the most staggering example of a government bailout has been the response to the COVID-19 pandemic, which led to a severe contraction in economic activity and employment as people all over the world stayed home to curtail the spread of the disease. On March 27, 2020, President Donald Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which provided more than $2 trillion in assistance. This included stimulus check payments of $1,200 per adult and $500 per dependent child.34 Another round of stimulus payments of $600 per qualifying adult and per dependent child was allocated as additional assistance funds at the end of 2020.35 Not even a year later, on March 11, 2021, President Joe Biden signed the American Rescue Plan Act into law, which delivered a third stimulus check of $1,400 for qualifying adults and each of their dependents.36 The American Rescue Plan, totaling $1.9 trillion, extended and/or amended many of the provisions included in the CARES Act, including a pause on federal student loan interest and a supplementary weekly unemployment benefit of $300.3738 Other measures included the Paycheck Protection Program, which funneled more than $500 billion to companies through the Small Business Administration to keep workers on the payrolls.39 Meanwhile, the Federal Reserve provided liquidity to financial markets by expanding its balance sheetby $3 trillion.40 What Was the Biggest Government Bailout? The biggest government bailout in history was the response to the COVID-19 pandemic. According to official U.S. government tallies, the U.S. has spent a total of $4.7 trillion on a variety of programs related to COVID-19 relief, as of June 30, 2023.41 What Was the First Big Government Bailout? The first big government bailout was during the Panic of 1792 when Treasury Secretary Alexander Hamilton approved purchases so as to prevent the securities market from collapsing. What Was the Biggest Bank Bailout? The biggest bailout for the banking industry was the government's Troubled Asset Relief Program (TARP), a $700 billion government bailout meant to keep troubled banks and other financial institutions afloat. The program ended up supporting at least 700 banks during the 2007–08 Financial Crisis. The Bottom Line Can the U.S. government continue to bail out troubled businesses such as Bear Stearns and AIG and government-backed institutions such as Freddie Mac and Fannie Mae? Many economists say no. The U.S. has run up trillions of dollars in debt and may not have the resources to fund huge bailouts in the future. Economics can be unpredictable, and no one can say what the future will bring in an ever-changing world in which the economies of emerging nations—especially China and India—can have major impacts on the U.S. But with new regulatory legislation and more vigilant oversight, bailouts of the magnitude that characterized the rescues of 2008 may be less necessary unless, of course, some exogenous shock as a pandemic strikes again.

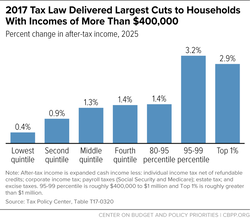

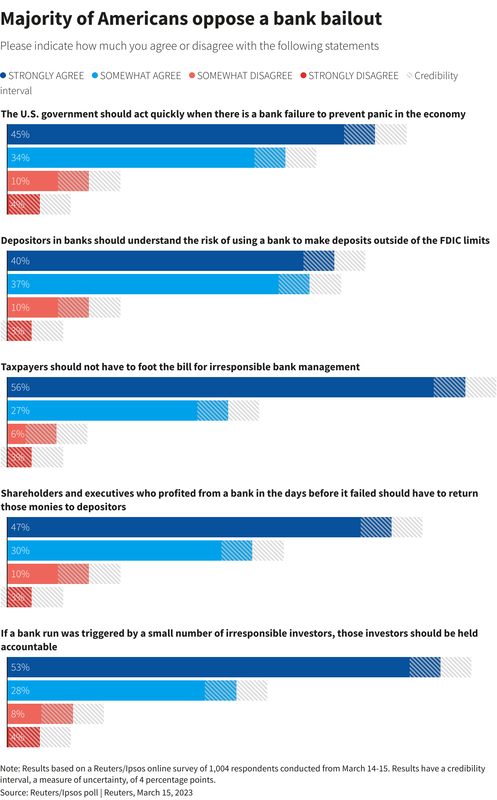

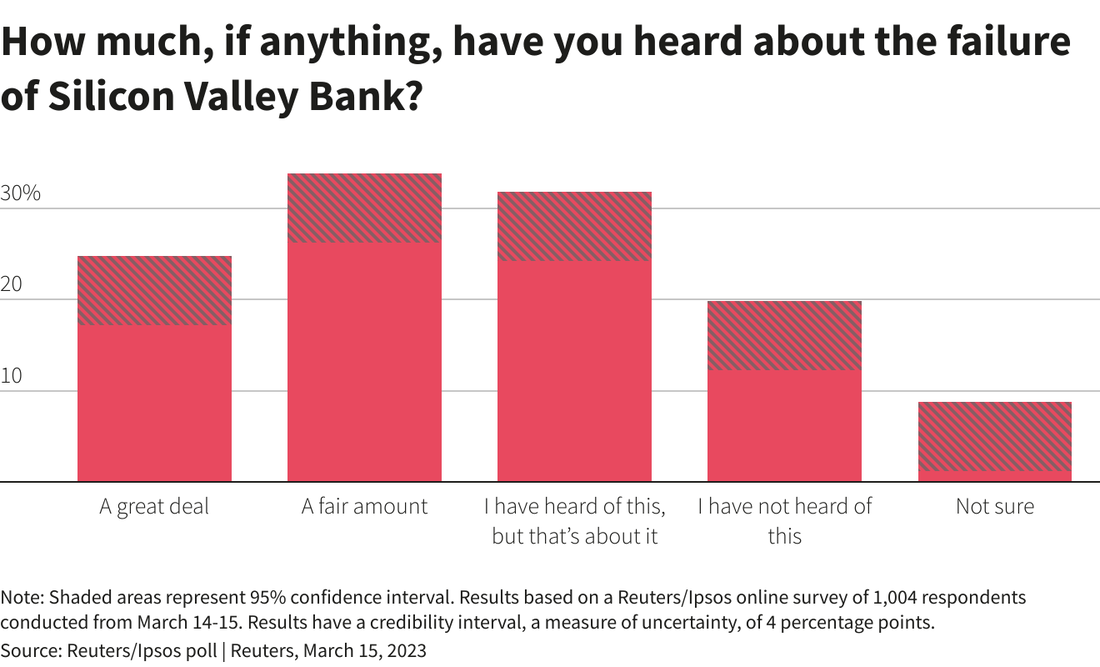

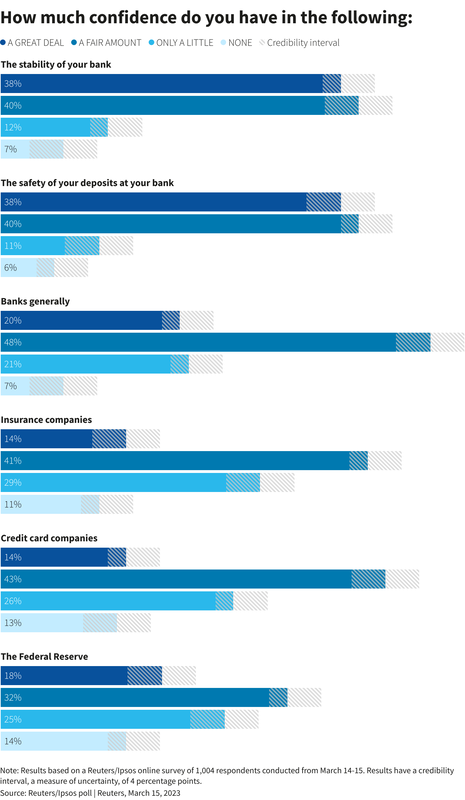

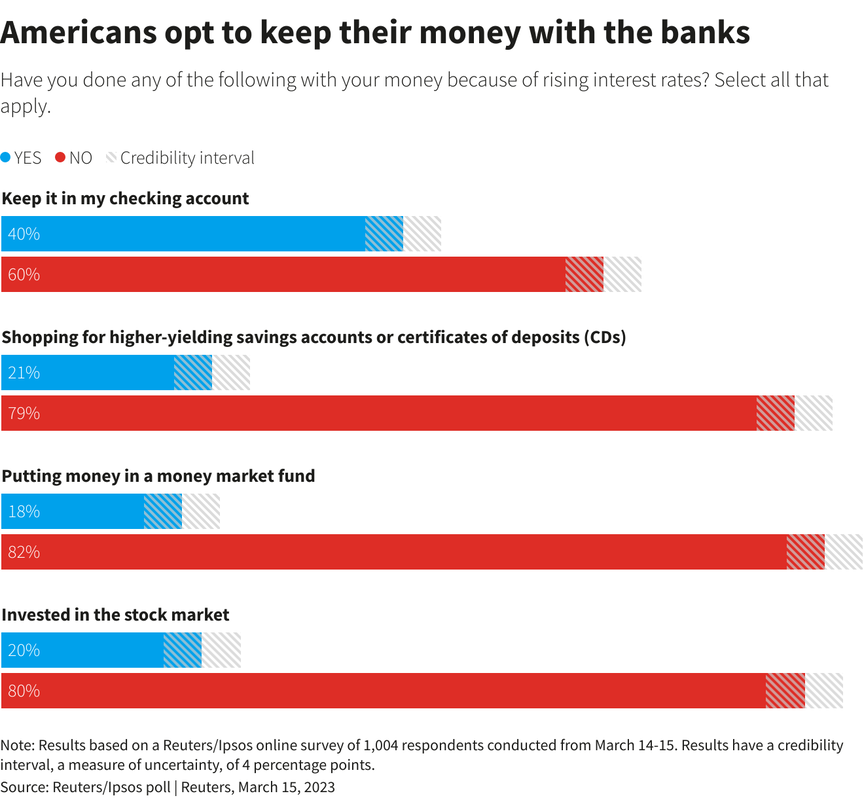

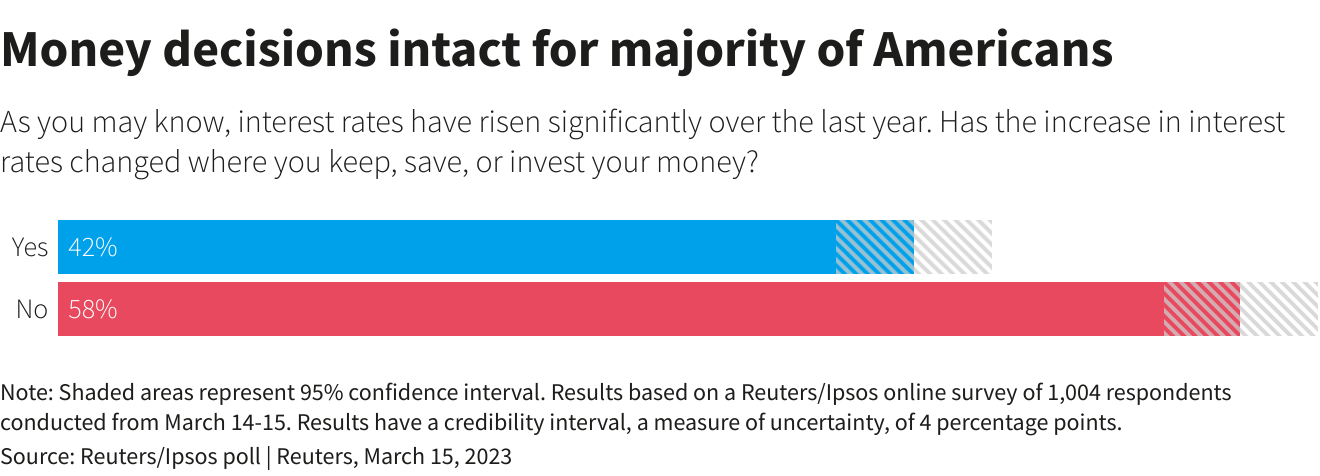

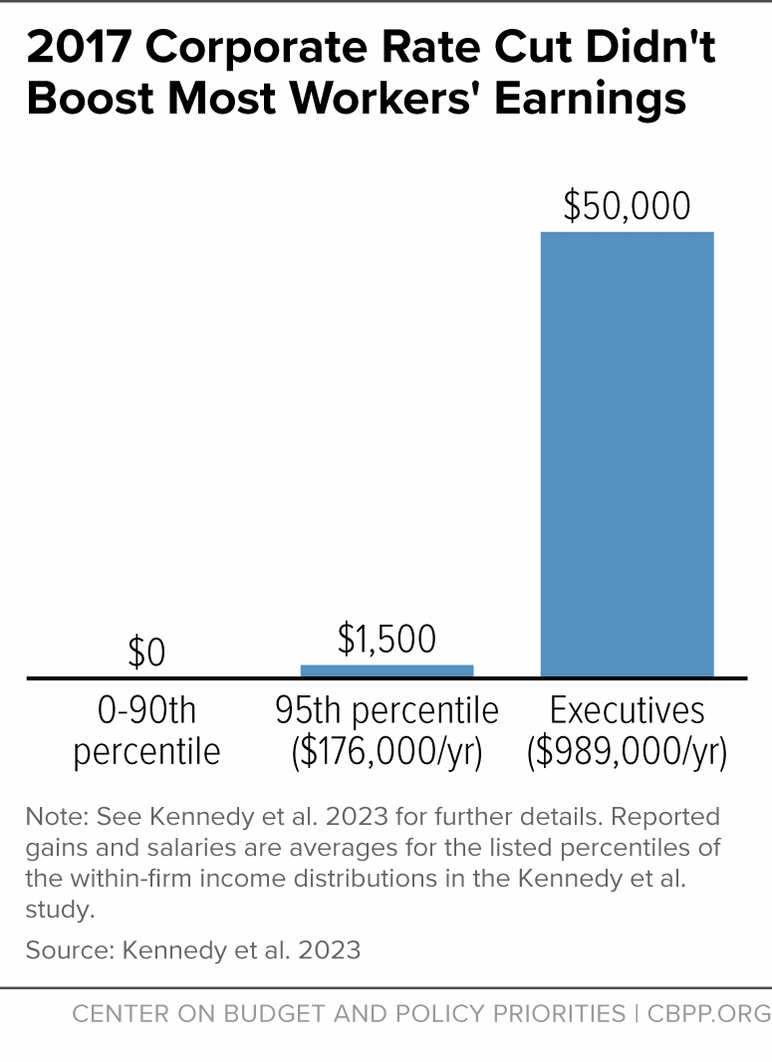

"PERFECTLY RIGGED MONOPOLIZED MARKETS" INSURING . . . . "ALL OF . . THE RETURNS . . FOR THE RUTHLESS CEOS & THE SUPER RICH!" . . "ALL OF . . THE RISKS . . FOR THE REST / TAXPAYERS / THOSE IN NEED!" THIRD YEAR, SOPHOMORE YEAR, AT THE U OF UTAH, I WAS IN A DOCTORAL SYMPOSIUM IN FINANCE. THE PROF, DR. RICHARD "DICK" PRATT, ASKED ME INTO HIS OFFICE A MONTH OR TWO INTO THE COURSE. HE SAID, WELL JIM, YOU HAVE GOTTEN QUITE A NAME FOR YOURSELF, TAKING MOSTLY GRADUATE COURSES FOR YOUR UNDERGRAD DEGREE. I HAD NOT TAKEN THE BACHELOR'S OR MASTER'S COURSE IN FINANCE, PRIOR TO DR. PRATT SIGNING FOR ME TO TAKE THE DOCTORAL SYMPOSIUM. HOWEVER, AS HE NOTED, YOU ARE THE ONE CRITIQUING MOST OF THE PAPERS, SO OBVIOUSLY, YOU ARE VERY SMART. HE SAID, THE PRESIDENT, REAGAN, THIS WAS 1981, IS CONSIDERING ME FOR THE HEAD OF THE "FEDERAL HOME LOAN BANK BOARD," THE AGENCY THEN REGULATING THE SAVINGS & LOANS. HE HAS ASKED ME FOR THE SOLUTION TO THIS PROBLEM. AS YOU KNOW S&LS MAKE THEIR MONEY LENDING LONG, AT TYPICALLY HIGHER INTEREST RATES, WHILE BORROWING SHORT-TERM, AT TYPICALLY LOWER INTEREST RATES. THE CURRENT SHORT TERM INTEREST RATES WERE THEN IN THE 8% RANGE, WHILE THEY HAVE LOANED OUT AT ROUGHLY 4% TO 6%, PRIOR TO THE INFLATION OF THE LATTER SEVENTIES. RESULTING IN THESE INSTITUTIONS LOOSING LOTS OF MONEY, AS THEIR YIELDS ON THEIR LOANS TO CUSTOMERS ARE MUCH LOWER THAN THE INTEREST RATES THAT THEY HAVE TO PAY ON THEIR SHORT-TERM LOANS! SO WHAT IS THE SOLUTION? I SMILED, AND SAID, "OH, THAT IS EASY!" DR. PRATT SAID, "WOW, I HAVE HAD THE BRIGHTEST MINDS IN THE US LOOKING AT THIS PROBLEM, AND THEY HAVE YET TO COME UP WITH ANY SOLUTIONS. I SHOULD HAVE SPOKE WITH YOU FIRST!" . . "HE SAID, OK, WHAT IS THE SOLUTION?" "I SAID, BANKRUPTCY, OF COURSE!" DR. PRATT SAID, "I DON'T THINK THAT THE PRESIDENT IS GOING TO LIKE THIS IDEA!" I THOUGHT TO MYSELF, BEING OBSESSED WITH NOAM CHOMSKY'S WORKS SINCE FRESHMAN YEAR, AND HAVING SAT IN THE DOCTORAL SYMPOSIUM IN POLITICAL ECONOMICS, SOPHOMORE YEAR, UNDER THE THEN CHAIRMAN OF THE UOFU ECON DEPARTMENT, "KAY" HUNT, A NORDIC MODEL ECONOMIST. "OH THAT IS RIGHT! THE RICH . . GET ALL OF THE RETURNS! AND . . THE REST . . THE TAXPAYERS . . AND THOSE IN NEED . . TAKE ALL OF THE RISK!" AS NOAM CHOMSKY CALLS IT "THE NANY STATE." "TAKES CARE OF THE RICH" WHILE "THE REST" TAKE ALL OF THE RISK. SIMPLY STATED "SOCIALISM FOR THE RICH!" WHEN I SPEARHEADED A "TECHNOLOGY DEVELOPMENT PROGRAM" FOR THE UOFU SBDC, THE TRIAD CENTER, OWNED BY THE INFAMOUS ARMS DEALER, ADNAN KASHOGGI, WENT INTO BANKRUPTCY. I READ IN THE SALT LAKE TRIBUNE AN ARTICLE ON A LAW PASSED BY THE RIGHT WING MORONS. THE AUTHOR STATED THAT THE LAW WOULD PROHIBIT THE THOUSANDS OF COMPANIES NOW FACING BANKRUPTCY FROM SUING THE TRIAD CENTER, OR ADNAN KHASHOGGI'S, ASSETS HELD OFFSHORE IN TAX HAVENS, FOR THE LIABILITIES OF THE TRIAD CENTER IN THE US. ALSO IN THIS LAW, THESE MORONS PROHIBITED PEOPLE FROM GETTING OUT OF STUDENT LOAN DEBT IN BANKRUPTCY COURT. MOST PERSONAL BANKRUPTCIES ARE DUE TO HEALTH CARE COSTS. DUE TO SATAN'S EMPIRE BEING THE ONLY DEVELOPED COUNTRY NOT PROVIDING FREE HEALTHCARE FOR ALL PEOPLE! THE AUTHORS OF THIS ARTICLE STATED, YOU CAN SEE THE MORALS OF THE AUTHORS OF THESE LAWS. TO WHICH I SAY . . "WHAT MORALS!" THEY ARE EVIL! Americans are wary of bailouts as banking concerns mount Reuters/Ipsos poll By Jason Lange March 15, 20233:28 PM PDT https://www.reuters.com/markets/us/americans-are-wary-bailouts-banking-concerns-mount-reutersipsos-2023-03-15/ WASHINGTON, March 15 (Reuters) - A bipartisan majority of Americans oppose U.S. taxpayers footing the bill when bad management causes a bank to fail, though Republican opposition to bank bailouts has softened over the last decade, a Reuters/Ipsos poll completed on Wednesday found. The poll's results point to a potential political problem for Democratic President Joe Biden's administration should the signs of shakiness in the U.S. banking sector worsen and prompt more aggressive government action. The two-day Reuters/Ipsos poll found 84% of respondents - including strong majorities of Republicans and Democrats - think taxpayers should not have to pay to resolve problems caused by irresponsible bank management. Stock markets have swooned around the world since Silicon Valley Bank collapsed on Friday as worried customers pulled their deposits. Two days later, New York's Signature Bank closed. On Wednesday, U.S. stocks fell sharply as turbulence at Swiss banking giant Credit Suisse (CSGN.S), opens new tab revived fears of a new banking crisis. Banks have been stressed in recent months by rising interest rates, which reduce demand for borrowing money. In a series of moves telegraphed in advance to investors, the U.S. Federal Reserve, America's central bank, has pushed interest rates higher over the last year in a bid to tame inflation. Only 49% of Americans - 40% of Republicans and 55% of Democrats - said they favored government bailouts of financial institutions. Still, support for bailouts was even more tepid a decade earlier, when the United States was emerging from a financial crisis which the government fought by spending hundreds of billions of dollars on bank bailouts. In a 2012 Reuters/Ipsos poll, only 20% of Republicans and 53% of Democrats said they supported bailouts. About half of respondents to the Reuters/Ipsos poll said they had heard at least a fair amount about Silicon Valley Bank's implosion. Sixty-eight percent said they had at least a fair amount of confidence in the stability of their own bank, and the same percentage had at least that level of confidence in banks more generally. Some 77% of respondents said that shareholders and executives who profited from a bank in the days before it failed should have to return those funds to depositors. U.S. regulators promised to make whole all depositors at Silicon Valley Bank and Signature Bank, even those with accounts above the Federal Deposit Insurance Corp's standard $250,000 limit, without taxpayers having to cover any costs. Businesses make up many of the bank clients whose money had not been previously guaranteed by the government. The Reuters/Ipsos poll showed broad bipartisan support for Washington backing bank deposits. Seventy-eight percent of respondents said the government should guarantee the deposits of individuals and 70% said Washington should backstop company deposits. But a strong bipartisan majority also said depositors in banks should understand the risk of using a bank to make deposits outside of FDIC limits. Some experts say the more expansive deposit guarantees regulators are applying for the troubled banks already amount to a bailout because they remove people's incentive to guard against financial risk. The Reuters/Ipsos poll, conducted online, surveyed 1,004 people nationwide and had a credibility interval of about 4 percentage points in either direction. The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and Failed to Deliver on Its Promises A 2025 Course Correction Is Needed MARCH 5, 2024 BY CHUCK MARR, SAMANTHA JACOBY AND GEORGE FENTON A high-stakes tax policy debate will accelerate this year through 2025 over the pending expiration of the individual income and estate tax provisions of the 2017 Trump tax law. Policymakers should use this opportunity to work toward a tax code that raises more revenues, is more progressive and equitable, and supports investments that make the economy work for everyone. As this debate unfolds, policymakers and the public should understand that the 2017 Trump tax law:

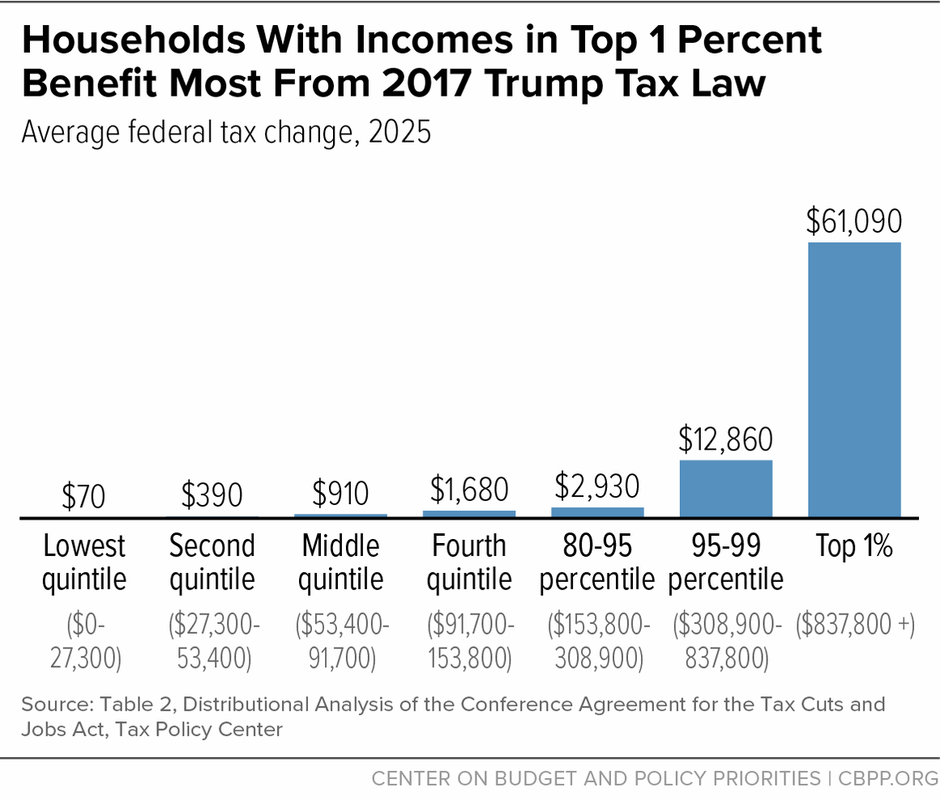

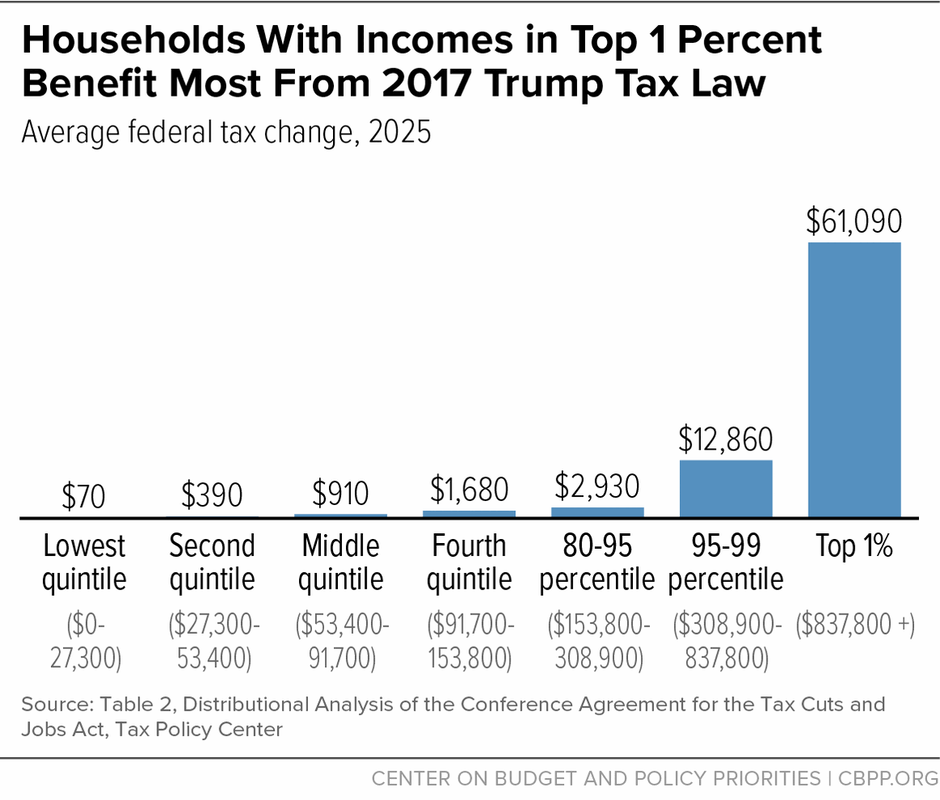

2017 Law Created New Tax Advantages for Wealthy People and Profitable CorporationsThe tax cuts [in 2025] will average $61,090 for the top 1 percent — and $252,300 for the top one-tenth of 1 percent.The law will boost the after-tax incomes of households in the top 1 percent by 2.9 percent in 2025, roughly three times the 0.9 percent gain for households in the bottom 60 percent, TPC estimates.[10] The tax cuts that year will average $61,090 for the top 1 percent — and $252,300 for the top one-tenth of 1 percent. (See Figure 1.) The 2017 law also widens racial disparities in after-tax income.[11] The 2017 tax law’s tilt to the top reflects several costly provisions that primarily benefit the most well-off:

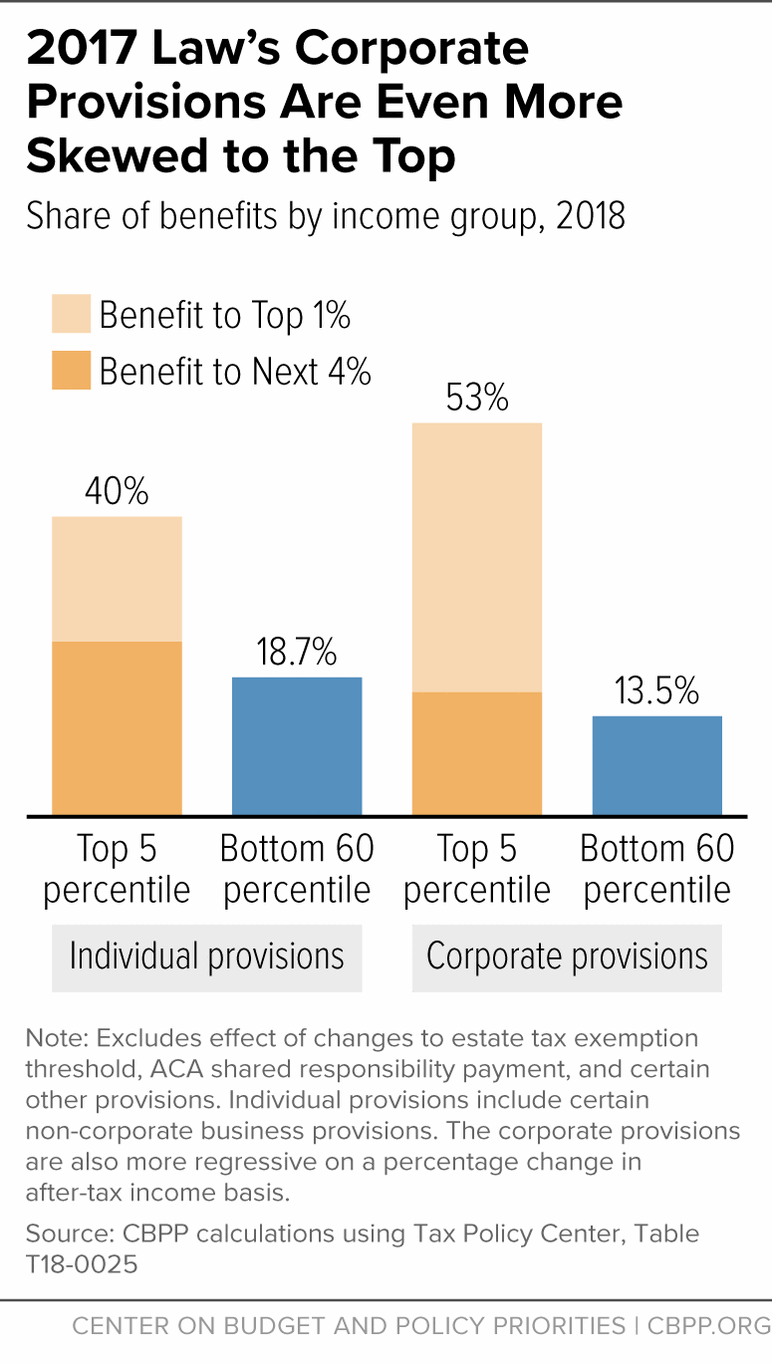

It’s Time to End the 2017 Law’s Windfalls for the WealthyFailing to allow the individual income tax and estate tax provisions to end as scheduled would benefit high-income households far more than other income groups. Extending them would boost after-tax incomes for the top 1 percent — those with incomes over $1 million — more than twice as much as for the bottom 60 percent as a percentage of their incomes in 2026.[16] In dollar terms, extending the expiring provisions only (that is, excluding the effect of the large corporate tax cuts the law made permanent) would result in a $48,000 tax cut for households in the top 1 percent in 2026, but only about $500 for those in the bottom 60 percent of households, on average.[17] As the 2017 law’s individual income and estate tax cuts approach expiration, policymakers and the public should keep two important dynamics in mind. First, in addition to the top 1 percent receiving very large tax cuts, the 2017 law delivered the largest average tax cut — measured as a percentage of pre-tax income — to households in the 95-99thpercentiles. Their tax cut from the 2017 law amounts to 3.2 percent of their pre-tax income, on average (or nearly $13,000, on average).[18]This is more than triple the roughly 1 percent average percentage income gain of the bottom 60 percent.[19] (See Figure 2.)  This is important because the Biden Administration’s pledge not to raise taxes on those with incomes below $400,000 is likely to feature prominently in the debate. The 95-99th percentile group is a rough proxy for people with incomes in the $400,000 to $1 million range, according to TPC. This group is often inaccurately referred to as the “upper middle” class. This is a misleading characterization. These people are in the top 5 percent by income in one of the richest countries in the world. They tend to have high levels of resources; their median net worth was over $3.9 million in 2022, according to an analysis of the Survey of Consumer Finances, compared to just $169,000 for those with incomes below $400,000 and just $52,000 for those with incomes in the bottom 50 percent of the distribution.[20] The $400,000 threshold is quite high, and policymakers should resist any efforts to increase it. These households are rich, they should be paying higher taxes, and their 2017 tax cuts should not be extended.[21] Second, these large, disproportionate income and estate tax cuts for high-income and high-wealth households come on top of the large benefits those households are currently receiving from the 2017 law’s permanent corporate tax cuts, which are tilted even more heavilytoward wealthy people than the expiring individual tax cuts.[22] In 2018, the first year the law was in effect, the top 5 percent of households received 40 percent of the individual tax cuts, and more than half of the law’s other tax cuts, which were primarily corporate tax cuts.[23] (See Figure 3.) These corporate tax cuts are even more concentrated at the very top, with the top 1 percent receiving 36.2 percent of the corporate provisions compared to 16.8 percent of the expiring individual provisions.

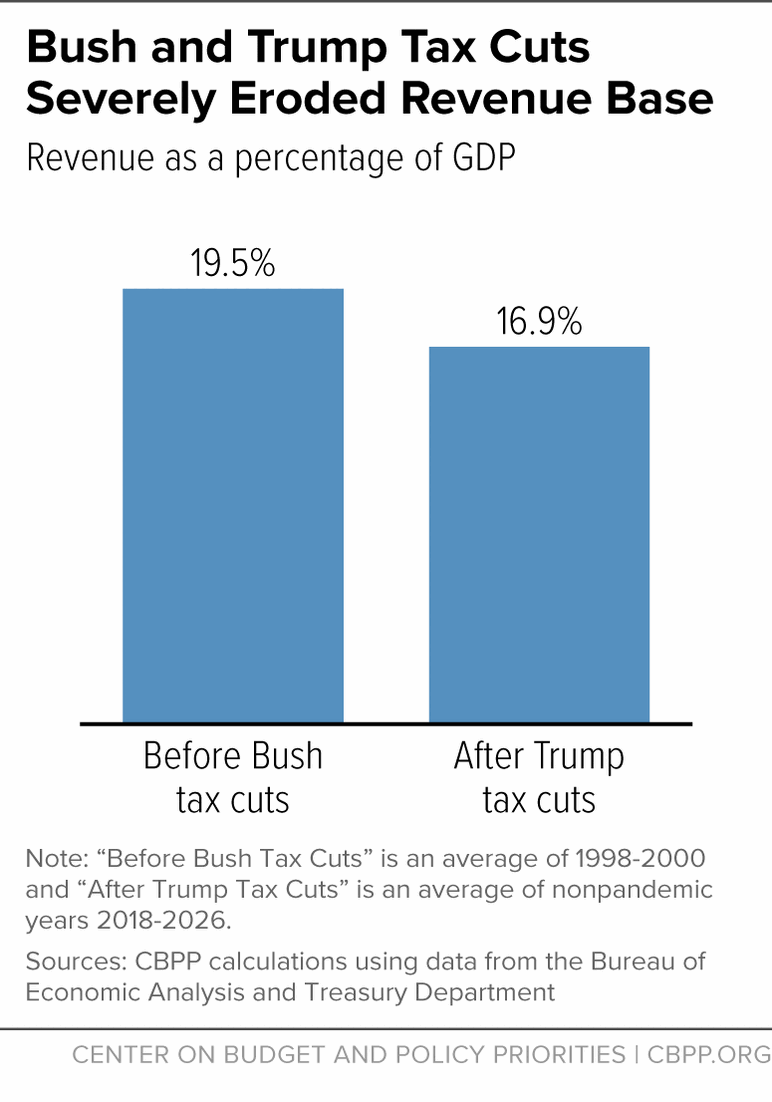

2017 Trump Tax Law Was Expensive and Further Eroded Our Revenue BaseTax cuts enacted in the last 25 years — namely, those enacted in 2001 and 2003 under President Bush (most of which were made permanent in 2012) and those enacted in the 2017 tax law — gave windfall tax cuts to the wealthy, costing substantial revenue, limiting the investments made to address national priorities, and adding trillions to the national debt.[25] The 2001 and 2003 Bush tax cuts, which reduced individual income tax rates, taxes on capital gains and dividends, and the tax on estates, cost roughly 2 percent of GDP in 2010.[26] The 2017 law took revenues even lower: CBO estimated in 2018 that the 2017 Trump tax cut will cost $1.9 trillion over ten years, on top of the cost of the Bush tax cuts also in place.[27]

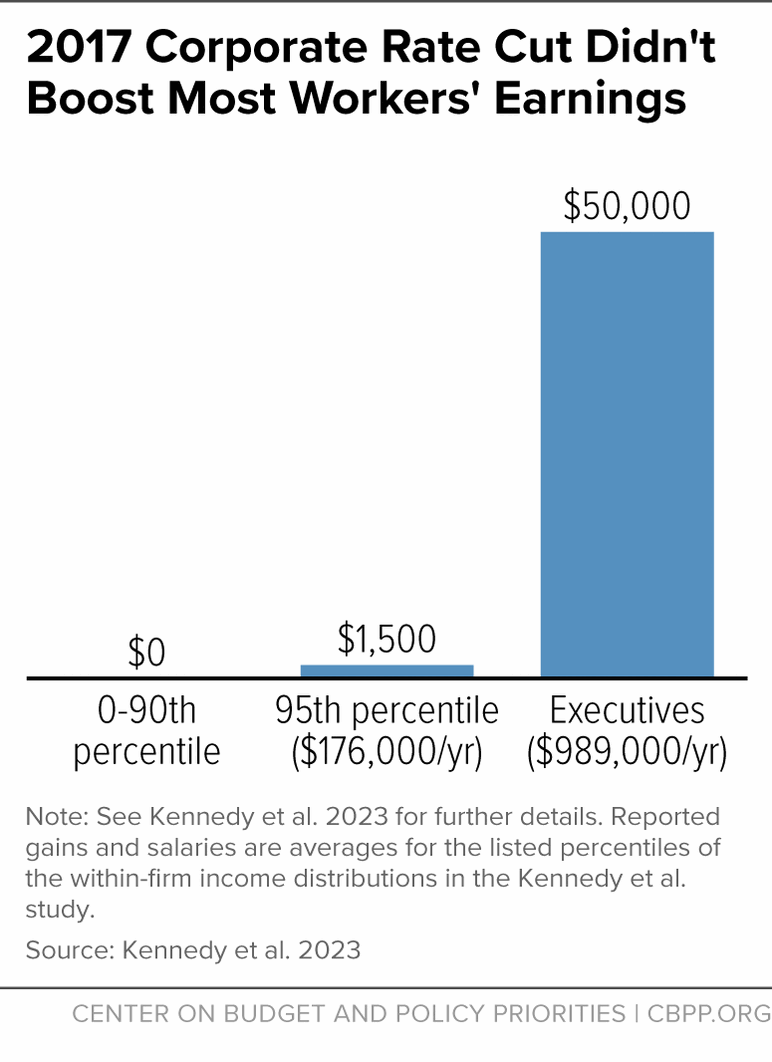

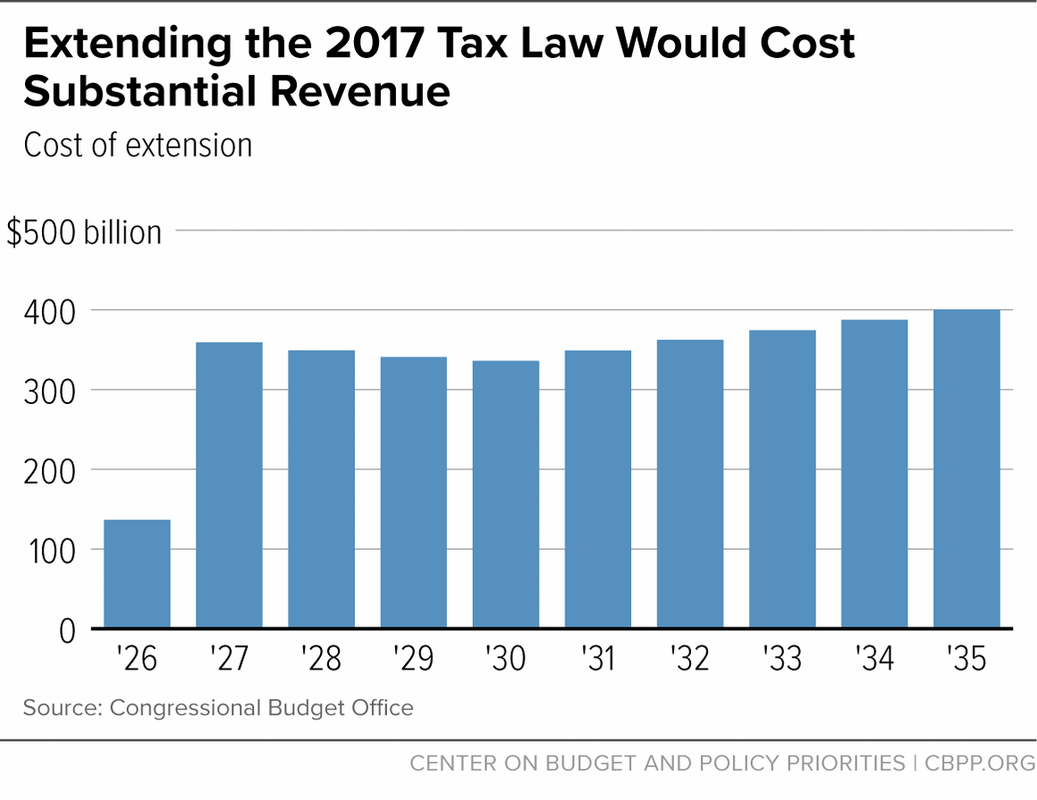

Revenues need to rise. Yet making the 2017 law’s individual and estate tax cuts permanent would cost another roughly $3.4 trillion from 2026 to 2035, or roughly $350 billion a year beginning in 2027.[33] (See Figure 5.) Lawmakers should reject this costly policy mistake. Trump 2017 Tax Law Failed to Deliver on Its PromisesDuring the 2017 debate, Trump Administration officials and prominent proponents of the corporate tax cut proposal claimed it would yield broadly shared benefits by boosting economic growth. President Trump’s Council of Economic Advisers claimed the rate cut would “very conservatively” lead to a $4,000 boost in household income.[34] But research to date has failed to find evidence that the gains from the rate cut trickled down to most workers. For example, a 2019 Congressional Research Service report on the law’s economic impact concluded, “There is no indication of a surge in wages in 2018 either compared to history or to GDP growth.”[35]Similarly, a 2021 Brookings Institution report noted that “The Trump administration claimed that the [2017 law] would provide significant benefits to workers,” but Brookings found “no evidence that any wage response close to these claims occurred in 2018 and 2019.”[36]

Another new study by a team of economists from Harvard, Princeton, the University of Chicago, and the Treasury Department estimates that the corporate tax cuts — including the cut in the corporate tax rate, full expensing for capital investments, and international tax changes — led to nearly dollar-for-dollar revenue losses, even after accounting for increases in economic activity due to those cuts, contrary to proponents’ promises that the cuts would pay for themselves.[40] The study does not examine how the corporate rate cut impacted earnings for workers with low and moderate incomes. It forecasts that in the long run, the corporate tax cuts could on average increase wages by about $750 per worker, an “order of magnitude below” proponents’ predictions;[41] the separate paper by JCT and Federal Reserve economists finds that wage and salary gains accrued only for workers in the top 10 percent of their firm’s earnings distribution. The special 20 percent deduction for pass-through business income is also heavily skewed in favor of high-income people because they receive most pass-through income,[42] they get a much larger share of their income from pass-throughs compared to other income groups,[43]and they receive the largest tax break per dollar of income deducted (because they are in the top income tax brackets). As a result, in 2019, the latest non-pandemic year for which data are available, the average pass-through deduction across all taxpayers who claimed the deduction was roughly $7,000, but it was nearly $1 million for the 15,000 taxpayers with incomes above $10 million who claimed the deduction.[44] Proponents argued the pass-through deduction would boost investment and create jobs.[45] Then-Treasury Secretary Steven Mnuchin, for example, argued the deduction would “be good for the economy; good for growth.”[46] But researchers have found no evidence that it provided any significant boost in economic activity and little evidence that it increased investment or broadly benefited non-owner workers.[47] Instead, it has encouraged more tax gaming, encouraging owners to reclassify their income as pass-through income that qualifies for the deduction.[48] The failure of the regressive Trump tax provisions to trickle down to the vast swath of workers should not be surprising given the track record of past trickle-down tax cuts. For example, studies of an even deeper tax cut for pass-through businesses in Kansas — a full exemption from state taxation for pass-through income — found that “the reform failed to generate real economic responses.”[49] More broadly, beyond the 2017 law, a 2023 review of the trickle-down literature by Carnegie Mellon University economist Max Risch found that “across different income tax policies that statutorily affect the rich, the evidence suggests the burden is predominantly born by the rich.” In other words, research indicates that tax cuts at the top don’t generally benefit workers with low and moderate incomes. By contrast, Risch concludes that “substantial evidence suggests large direct, but also potential ‘trickle-up’ effects from providing benefits to low-income or vulnerable households.”[50] A Tax Policy Course Correction Is Needed in 2025Given the 2017 law’s deep flaws — it’s skewed to the top, costly, and has failed to deliver on its economic promises — policymakers should seize the opportunity the 2025 expirations provide and make a course correction. Regressive tax policies should be replaced with progressive ones, our tax system needs to raise more revenues, and our fiscal priorities need a fundamental reset. Several key principles should guide this new course:

TOPICS: FEDERAL TAX, PERSONAL TAXES, BUSINESS TAXES, TAX CREDITS FOR INDIVIDUALS AND FAMILIES

0 Comments

Leave a Reply. |

"ONE LOVE"

"GOD'S LOVE!" PERMANENT . . CEASEFIRE! . . NOW! . .

TWO STATES! . . NOW! ISRAEL AND US WANT THE WATERFRONT OF GAZA AND THE OIL OFFSHORE OF GAZA!

VLAD WANTS UKRAINE'S GAS OIL PIPELINES FOOD PORTS AND DOESN'T WANT NATO ON ITS DOORS. CHENEY & BUSH . . THE EVIL RIGHT WING ROCKEFELLER TOLD US ON LAST 13 MIN OF ZEITGEIST DID 9/11, DOING GENOCIDE IN IRAQ & AFGHANISTAN TO TAKE OVER THE MIDDLE EAST THEN VENEZUELA WITH PLANS TO CHIP EVERYONE! KILLING THOSE THAT STOOD AGAINST THEM! GLOBAL GENOCIDE! "THANK GOD!" . . "IT IS . . THE END!" . . OF "RUTHLESS RULE" . . BY "THE EVIL RICH!" AMEN! UPDATED . . THE MOST IMPORTANT POST ON GOD'S SITE: "ENTER THE NARROW GATES!" TRUE NORDICS! THE GREEN PARTY! JILL STEIN BERNIE AOC THE SQAD! WIDE & BROAD ARE THE GATES TO HELL! TOTALITARIAN GANGSTER CAPITALISM & SOCIALISM! FORETOLD! "DONNY THE DEVIL!" OF SATAN'S EMPIRE! DAMN TRANS/GTLBX = GOD DAMNS U! SIBERIAN METHANE + HOT HOUSE EARTH + AMOC SHUTDOWN = "THE SIBERIAN MONSTER HURRICANE BERYL!" CAT 6! 150 F PLUS! SOON! "HOT STUFF!" "THE SIBERIAN METHANE MONSTER!" CAUSES THE METHANE HEAT WAVE AND SURFACE FIRESTORM! THE FIREY WAVES OF DEATH! BY 2027-30! CHRIST LAID OUT IN THE 1,500 TO 2,000 UNIQUE WORDS THAT THEY ESTIMATE HE SPOKE IN THE GOSPELS, THAT SUPPORTING . . "THE NORDIC MODEL" . . IS THE PATH TO ENTERING . . "THE NARROW GATES" . . INTO ETERNITY IN CHRIST'S / GOD'S HEAVEN. "THE FINAL TESTAMENT," WHICH I HAVE LAID OUT HERE. CHRIST TOLD ME TO JUST USE HIS WORDS HERE, TO SHOW THAT CHRIST . . "LOGICALLY" WAS THE FIRST . . RADICAL PACIFIST ANTI-WAR LIBERTARIAN DEMOCRATIC MARKET SOCIALIST . . THE FIRST NORDIC MODEL ECONOMIST! THE LOGIC OF THE GOD OF LOVE! NOTABLY A DANE. AS THE DANES HAVE PROVEN BY . . "THE FRUITS OF THEIR EFFORTS" . . THAT THEY HAVE CREATED THE MOST . . SUSTAINABLE HUMANE AND EGALITARIAN SOCIETY . . "AS IT IS IN HEAVEN! SO SHOULD IT BE ON EARTH!" . . THEY ARE MOST BLESSED NOW & IN HEAVEN! THE NORDICS, NOTABLY THE DANES, HAVE CREATED THE MOST BLESSED SOCIETIES/Y THAT . . "TAKES CARE OF THOSE IN NEED!" THE PRIMARY CRITERIA CHRIST SAID WILL DETERMINE IF YOU ARE BLESSED TO LIVE FOR ETERNITY IN HEAVEN, IN THE FINAL JUDGEMENT! NOT! THE RUTHLESS GREED FOR MONEY FOR THE SUPER RICH! BE BLESSED! SUPPORT . . THE NORDIC MODEL! . . BERNIE AOC THE SQUAD, THE TRUE PROGRESSIVES SUPPORTING . . "GOD'S MODEL!" . . "THE NORDIC MODEL!" The Purpose of Life Pray "Help Me To Love Others The Way YOU Love Me!" This IS ALL YOU NEED to Become One With God! I LOVE YOU SOO MUCH! "JC!" THE GOD OF LOVE!

JIM'S SUGGESTIONS: PRACTICE FOR HEAVEN! "LIVE LIKE THE PLANET IS DYING!" It Is THE END! LOVE MORE, AND LOVE MORE PEOPLE! TRY! FIND A CAUSE! GIFT AS MUCH AS YOU CAN! TO "THOSE IN NEED!" GIFT MOST OF YOUR WEALTH TO GOD! TO "THOSE IN NEED!" IF YOUR EVIL GREED HAS ENGULFED YOUR SOUL! IF YOU ARE VERY RICH! SUPPORT "AS IT IS IN HEAVEN, SO SHOULD IT BE ON EARTH!" SUSTAINABLE, HUMANE AND EGALITARIAN! "THE SHE NORDIC MODEL!" JILL STEIN BERNIE AOC & THE SQUAD! AND . . "BECOME ONE!" REALLY OPEN YOUR LIFE TO GOD'S LOVE! GOD WANTS TO BE YOUR BFF! LET GOD GUIDE AND FULFILL YOU! LOVE GOD WITH ALL OF YOUR PASSION! EVERY DAY! IF YOU DON'T BELIEVE IN GOD! BE A "GOOD HUMANIST!" AND . . "I WILL SEE YOU IN HEAVEN SOON!" JIM "JAZZIE" GOD'S TRANS GENDER DAUGHTER. CHANNEL FOR WRITING "THE FINAL TESTAMENT OF JESUS SARAYU MAMMA AND FATHER GOD!" "THE ONE!" TRANS MRS DENMARK! DANISH CHRISTIAN HUMANIST! FOCUSED ON "THOSE IN NEED!" IN MY DREAMS! VERY FEM! THE PRIMARY CHANGE FROM 2016 GENDER SOCIETY OVERVIEW BELOW. WHERE I FORECAST 2100 FOR "ICE FREE ARCTIC" WAS THE START OF MASSIVE METHANE RELEASE DOCUMENTED FROM 2016-2017.

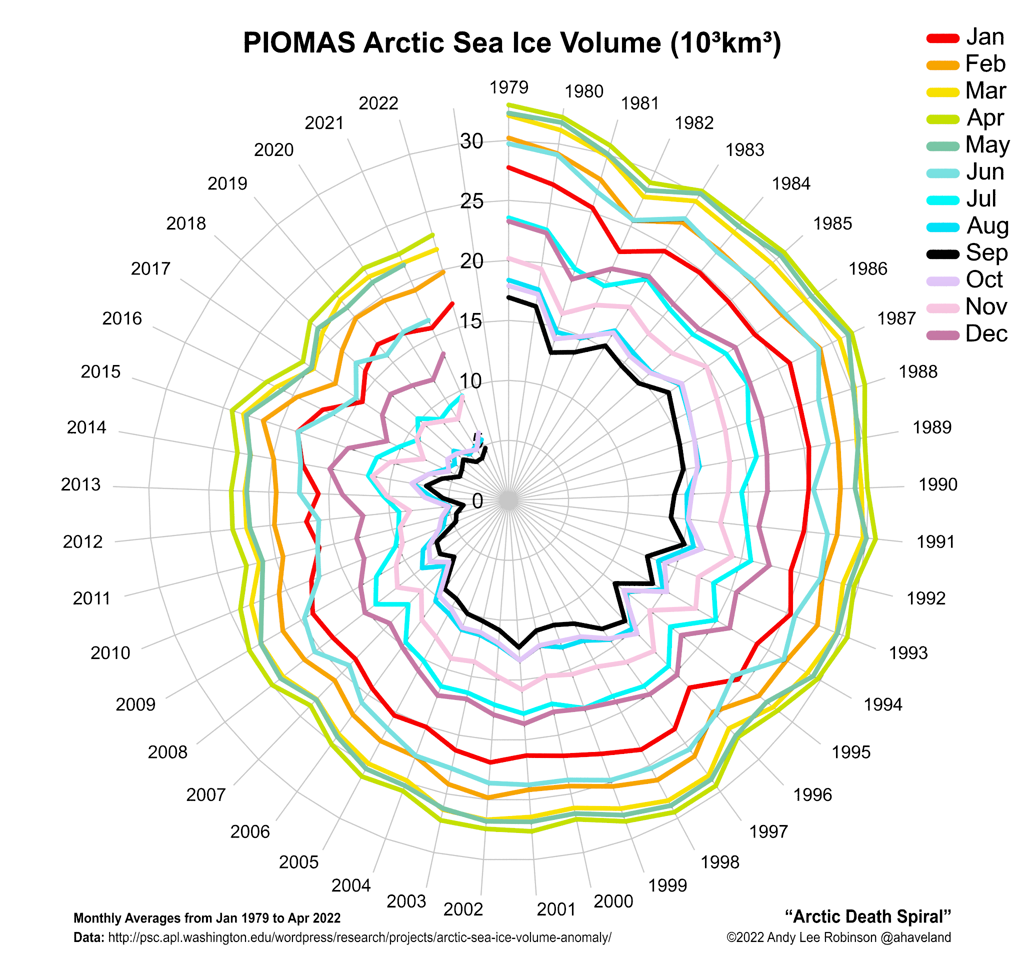

IN 2017 DR. PETER WATAMS CAMBRIDGE FORECAST "ICE FREE ARCTIC" BY 2025! CHRIST SAID, THIS IS WHEN "MY MOST PROFOUND PROPHECY" WILL BE FULFILLED! AT THE END TIMES, IT WILL BE LIKE NOAH & SODOM & GOMORRA, ONE DAY NORMAL, NEXT HELL ON EARTH.

GOD’S . . JC’S . . PROGRESSIVE NEWS, SCIENCE & TRUE CHRISTIANITY! . .

. . “THE LIBERATION THEOLOGY OF JESUS CHRIST!” . . “JC!”. . . . “ALL TRUTH!” . . . . “NO LIES!” . . TO HELP PREPARE . . . . “YOUR SOUL!” AS . . . . “It Is THE END!” . . . . . . “SAVE YOUR SOUL!” . . . “BECOME ONE!” NOW! PLUS . . . . . . MORE PROGRESSIVE NEWS, INSIGHTS AND ANALYSIS . . IN 1 POST . .THAN CNN IN A YEAR! CHRIST STATED: I HAD TO COME TO TELL "YOU" "MY FATHER'S WILL!" WHICH MY FATHER HAS UPDATED TO TODAY! ON "GOD'S SITE!" SOON! "YOU" WILL BE JUDGED! BY HOW "YOU" "DO MY FATHER'S WILL!" "TAKE CARE OF THOSE IN NEED!" NOT "YOUR EVIL GREED!" OR "FRY BABY FRY!" IN THE IMPACTS OF "YOUR EVIL GREED!" . . VERY SOON! "The Spirit of the Lord is upon me; he has anointed me to tell the good news to the poor. He has sent me to announce release to the prisoners and recovery of sight to the blind, to set oppressed people free, and that the time of the Lord ’s favor has come.” Luke 4:18-19 Christ's Message is . . Good News for The Poor Imprisoned Blind and for The Oppressed! It is . . "The Last Warning" for . . THE EVIL RICH and The Oppressors! The EVIL Republicans Right Dems Right Independents and Right Anti-Christians! Support The Nordic Model Now! Gift Your Evil Income & Wealth! Or Fry in Hell You caused! "Depart From ME!" "Ye" "That Have Worked" . . "The Most Evil Iniquity of Wealth, Income & Justice! Of ALL TIME!" "To THE REST!" . . Do what Tori sings so amazingly in the first video. Pray "Help Me To Love Others The Way YOU LOVE ME!" Support "As it is IN HEAVEN!" Sustainable Humane and Egalitarian . . "The Nordic Model!" Bernie / AOC / The Squad! Now! Gift as much as you can! Little did I know over the past 20 plus years of going to Maui, our favorite spot, and laughing at the sign below, that "Christ" would select me to "prepare the way!" Truly "Jesus Is Coming Soon!" By 2025-2030! Soon after "The ARCTIC is Ice Free!" The Spiral below goes to Zero! Prepare your Souls! . . NOW! THESIS SUMMARIES & Key Links SideBar Below THE FINAL TESTAMENT OF JESUS CHRIST! “THE LOGICAL GOD OF LOVE!”

"MY HIS STORY" My journey with "JC!" My BFF! The Only Reason! "Become One!" NOW! In process but most is here or on my "Jazzie" page. "JAZZIE" . . "LITTLE Jc" My Trans story written in spring 2016. "His Site" was launched in 8/2015. Amazing how little has changed! Need to join Gender Society to read bios! The primary NEW INFO. Methane Release has skyrocketed! Which I have documented here! Hence, "It Is THE END" by 2030! Not by 2100! CLICK HERE FOR THE PDF FILE! . . OF . . "JAZZIE!" . . "LITTLE Jc!" VISIT GENDERSOCIETY! PROVING . . CHRIST'S MOST PROFOUND PROPHECY! . . BY 2022 TO 2027! PLEASE READ "CHRIST'S MOST PROFOUND PROPHECY!" WHEN "THE ARCTIC IS ICE FREE!" "STRONG EL NINO COLLAPSE OF THE AMOC & THE 2ND COMING!" "BECOME ONE II!" TRANS HELL! PASSIONATELY LOVE GOD! NOT MONEY! "LOVE OTHERS WITH GOD'S LOVE!" GIVE YOUR WEALTH & LIFE TO GOD! WELCOME TO "THE END OF THE WORLD!" "THANK GOD!" "It Is THE END!" PUTIN STARTS WWIII! 1 "THE FINAL JUDGEMENT" BY 2027! DURING "THE SECOND COMING!" MOST BLESSED - "NORDIC MODEL SUPPORTERS!" THE MOST DAMNED "THE EVIL RICH & RIGHT WING ANTI-CHRISTIANS!" JOE DO "THE SUMMIT TO SAVE OUR SPECIES!" AND "ONE LOVE!" NOW! PREPARE YOUR SOULS - NOW! BECOME "ONE" WITH "THE ONE!" NOW! THE END IS MUCH CLOSER THAN YOU THINK! WHEN I SPEAK - "AS MY FATHER" - I SPEAK - "FOR MY FATHER!" BECOME ONE! - NOW! HIS CHANNEL! LOVE U! MY PRIMARY ROLE IS AS MY CLOSEST SPIRITUAL BROTHER, JOHN THE BAPTIST, TO PREPARE THE WAY! LOVE U! LOVE GOD WITH ALL OF YOUR HEART! DEVOUT YOUR SOUL LIFE & WEALTH TO - “THE GOD OF LOVE!” NOW! NOW! TRY TO LOVE ALL OTHERS WITH GOD’S LOVE! BE OF PEACE! FORGIVE THE WAY YOU WANT TO BE FORGIVEN! PRAY FOR YOUR FORGIVENESS FOR CHOOSING MONEY OVER GOD! INIQUITY OVER EQUITY! FOR NOT SUPPORTING THE ONLY OBVIOUS EGALITARIAN SOCIETIES OF GOD’S LOVE - HELPING “THOSE IN NEED!” THE NORDIC MODEL COUNTRIES! FOR SUPPORTING “THE GREED OF THE FEW!” VERSUS HELPING “THOSE IN NEED!” FOR - NOT BECOMING “ONE WITH - THE ONE!” GOD’S LOVE! Matthew 7:21-23 King James Version 21 Not every one that saith unto me, Lord, Lord, shall enter into the kingdom of heaven; but he that doeth the will of my Father which is in heaven. FATHER’S WILL IS TO HAVE SUSTAINABLE HUMANE AND EGALITARIAN SOCIETIES/MARKETS! ”THE NORDIC MODEL!” AS IT IS IN HEAVEN IT SHOULD BE ON EARTH! 22 Many will say to me in that day, Lord, Lord, have we not prophesied in thy name? and in thy name have cast out devils? and in thy name done many wonderful works? 23 And then will I profess unto them, I never knew you: depart from me, ye that work iniquity. RIGGED! KOCHS TAKE OVER COVID & HEALTHCARE! "ICE FREE ARCTIC!" UNLEASHES "HOT STUFF" "GIGATONS OF METHANE!" CAUSED BY STRONG EL NINO EARTHQUAKES SUPER STORMS AMOC COLLAPSE REDUCED ALBEDO BY 2023-2027! ADD "LATENT HEAT OF FUSION!" = "MELTING OF ANTARCTICA!" JOE DO "THE SUMMIT TO SAVE OUR SPECIES!" AND "ONE LOVE!" OR FRY WHEN YOU DIE! METHANE EXPLODES! IPCC ISSUES NO METHANE NON-SCIENCE! ARCTIC ICE BY GEOENGINEERING!? AMOC COLLAPSE EXPLODES GULF TEMPS! SUPER STORMS DESTROY GULF BY 25! "It Is THE END!" 2030! REMEMBERING - CHENEY BUSH STOLE B-TRILLIONS DOING 9/11! A NEWS WOMAN CALLED BLD 7 DOWN LIVE ON TV! ROCKEFELLER TOLD RUSSO 9/11 WOULD HAPPEN 11 MONTHS BEFORE AND ROCKEFELLER TOLD RUSSO "SATAN'S MAFIA GLOBAL DEPOPULATION AND POLICE STATE AGENDA!" NO VACCINES FOR POOR COUNTRIES IS SATAN'S MAFIA DEPOPULATION AGENDA! It Is THE END! ENJOY HELL! "THANK GOD!" . . "It Is THE END!" . OF . "RUTHLESS RULE BY THE EVIL RICH!" THEIR OPERATORS AND ANTI-CHRISTIAN WHORES! . . OMG! "THE ARCTIC OCEAN" IS . . "ON FIRE!" . . "HOT STUFF!" WILL ARISE ON "TRUMPET COCAINE!" SOON! THE FINAL WARNING TO "SATAN'S STATES OF EVIL GREED!" "SUPPORT THE NORDIC MODEL" & "GIVE TO THOSE IN NEED!" THE NORDIC THEORY OF LOVE - VS - SATAN’S EMPIRE OF EVIL GREED’S THEORY OF “ALL FOR ME!” “FUCK YOU-ISM!” OR "FRY BABY FRY!" SOON! STAND AGAINST THE PURE EVIL INIQUITY OF WEALTH INCOME & JUSTICE IN THE US & GLOBALLY! SEEK - NOT - TO STORE UP WEALTH ON EARTH! BUT IN HEAVEN! RARELY WILL A RICH PERSON ENTER HEAVEN UNLESS THEY GIVE AWAY THEIR INSANE INCOME (BAGS OF HARVEST) AND INSANE WEALTH (HUMPS ON THEIR BACKS) TO “THOSE IN NEED!” FOR THE LOVE OF GOD! WILL THEY FIT THROUGH THE EYE OF THE NEEDLE! HEAVEN! WORTH OVER $5 MILLION? GIFT EXCESS OVER $5 MILLION IN ASSETS AND A $5 MILLION HOUSE PER FAMILY BY 2025! IS YOUR NET WORTH FROM $1 TO $5 MILLION - GIFT 10% OF TOTAL INCOME! UNDER $1 MILLION - WHAT YOU CAN! T0 - “THOSE IN NEED!” STRETCH! SHOW GOD HOW MUCH YOU LOVE GOD! BY SHOWING YOUR LOVE FOR - THOSE IN NEED! YOUR LOVE AND HELP FOR - “THOSE IN NEED” - MAY - “SAVE YOUR SOUL!” SAVE A CHILD IN NEED! GIVE THAT CHILD A GOD / GOOD CENTERED HOME AND UPBRINGING! THE CHILD’S LOVE WILL SAVE YOUR SOUL! DON’T GET TOO MANY CHILDREN! ONE IS GOD! IT IS SIMPLY WHAT - “A GOOD SOUL” - WORTHY OF ETERNITY - ONE IN GOD’S LOVE WOULD DO! BY 2023-2027 IT WILL BE - MAD MAX! RAISE YOUR SPIRITS UP TO GOD! “ASCENSION THURSDAY 2025!” OR SPIRITUALLY MEANINGFUL DAY TO YOU! A NICE SUNSET! GET YOUR SUCK BAGS - NOW! PREPARE YOUR SOUL! PREPARE YOUR FAMILIES! LOVE GOD! GIVE TO & HELP THOSE IN NEED! SUPPORT “THE NORDIC MODEL!” NOW! . . NOW! NARROW IS THE ENTRANCE TO HEAVEN! THE NORDIC MODEL SUPPORTERS! WIDE IS THE GATE TO HELL! THOSE NOT SUPPORTING SUSTAINABLE HUMANE AND EGALITARIAN! MY MAIN GOAL! . . . . “TO SAVE YOU!” LET JESUS, SARAYU AND MAMMA - “THE LOGICAL GOD OF LOVE!” GUIDE YOU HOME! NOW! “GET YOUR SUCK BAGS” NOW! TIME TO “RAISE OUR SPIRITS UP TO GOD!” BY “ASCENSION THURSDAY 2023” AT THE LATEST!

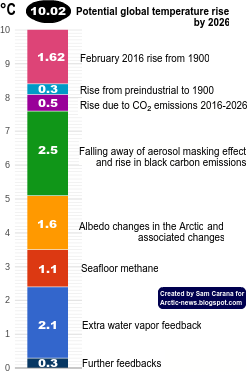

MY MAJOR SCIENTIFIC ARGUMENTS: WITH ONLY A 3-5C RISE IN GLOBAL TEMPS GMAT, ABOVE PRE-INDUSTRIAL TEMPS, 2-3 ABOVE TODAY, CORE SAMPLES BY ANDRILL IN ANTARCTICA PROVED THAT IT CAUSED 60 FEET PLUS SEA LEVEL RISE. ANTARCTICA MELTED 60 TIMES AT THESE TEMPS, WEST AND EAST. PER SAM CARANA 2 C WAS HIT FEB 2020. AN ADDITIONAL 1-3C WILL BE HIT BY 2023-2027! “The last time the Earth experienced a comparable concentration of CO₂ was 3-5 million years ago, when the temperature was 2-3°C warmer and sea level was 10-20 meters (30’ TO 60’) higher than now. But there weren’t 7.7 billion inhabitants,” said WMO Secretary-General Professor Petteri Taalas. 30’-60’ SEA LEVEL RISE BLOWS UP MOST OF THE 440 NUCLEAR REACTORS! DUE TO “THE REDUCTION IN GLOBAL DIMMING” - CAUSED BY DR DEATH’S KILLER COVID! CAUSING A COLLAPSE IN GLOBAL ECONOMIES! “HOT STUFF” “THE CLATHRATE GUN FIRING ON TRUMPET COCAINE” WILL HAPPEN BY 2025! DUE TO “COMPLETELY ICE FREE ARCTIC” BY 9/2023-9/2027! “MASSIVE RELEASES OF SIBERIAN METHANE” WILL CAUSE 2-3C RISE IN GMAT BY 2025-27! MELTING ANTARCTICA WEST & EAST RAPIDLY! CAUSING 60’ SEA LEVEL RISE BY 2025-2030! THIS DESTROYS MOST OF THE 440 NUCLEAR REACTORS. GAME OVER “It Is THE END!” HENCE MY PROPOSAL FOR 350-400’ PYRAMID STRUCTURES AROUND NUCLEAR REACTORS, SINCE WATCHING THE ANDRILL VIDEO 2017. ALONG WITH “SIBERIAN METHANE CAPS” TO SEQUESTER METHANE! STORING IT IN TANKS! “THE MONSTER SUPER STORMS” AND STORM SURGE MAY DESTROY NUCLEAR REACTORS, SOONER THAN SEA LEVEL RISE. BY 2025 THE GULF & FLORIDA WILL BE DESTROYED BY “THE MONSTER SUPER STORMS” - EXIT NOW! THIS IS “HERD GENOCIDE“ - NOT - “HERD IMMUNITY!“ THIS IS THE GLOBAL DEPOPULATION AND POLICE STATE AGENDA! “It Is THE END!” BY 2030-2040! “HERD GENOCIDE!” NOT “HERD IMMUNITY!” PART II. Americans Are Dying At Rates Far Higher Than Other Countries! 8 MILLION MORE POOR! “HERD GENOCIDE III” COVID LONG-HAULERS! ACCELERATES “GLOBAL DIMMING!” CAUSING “ICE FREE ARCTIC!” 9/2022 UNLEASHING “HOT STUFF!” MELTING ANTARCTICA! GMAT 2-3C RISE = 60’ SEA LEVEL RISE 2025-30! BLOWING UP 440 NUCLEAR REACTORS! “THE END!” MY PRAYER FOR - “THE REST” - SUPPORTING - “THE EVIL RICH!” CHRIST’S COMMANDS US TO - COMMAND THE RICH TO “TAKE CARE OF THOSE IN NEED!” TO ENTER HEAVEN! MY INSPIRATIONS OF WHAT YOU MUST DO IN TODAY’S TERMS - TO ENTER GOD’S HEAVEN! MOVE TO - CANADA - NOW! IF YOU CAN! BANF TO LAKE SUPERIOR UP TO HUDSON BAY, EAST. NORDIC COUNTRIES. NEW ZEALAND IF YOU CAN AFFORD TO. LAKE TAHOE, LAKE CHAMPLAIN, GREAT LAKES EAST TO COAST IN US! MUCH OF MY WORK IS IN ALL CAPITALS - most of others works are in non-caps. Sources are linked - blue text. POSTS TO RAISE YOUR SPIRIT UP TO GOD HUMANELY: GUYMCPHERSON.COM MAXDOGBREWING.COM PEACEFUL PILL HANDBOOK.COM SUICIDE.ORG DUE TO - “THE LATENT HEAT EFFECT!” - UNLEASHING - “HOT STUFF!” I COMPARE MY FORECAST FOR EXTINCTION TO SAM’S AND GUYS!!” CAUSING GMAT TO RISE BY 18 C / 32.4 F BY 2026 ACCORDING TO SAM CARANA!

LOTS OF VIDEOS - TAKES TIME TO LOAD! New Topic /Videos Each Post Plus Key Videos ALL CREDIT FOR TRUTH IS TO - "THE ONE" - THE SUNSHINE BAND AND AUTHORS NOTED. MY CREDIT IS FOR ANY MISTAKES! SORRY! THE NORDIC MODEL & The Final Judgement: Take Care of "Those in Need!" Or Fry in Hell! Christ IS "The First Great SOCIALIST!" Last Warning! SUPPORT THE NORDIC MODEL or FRY Baby FRY! WHEN YOU DIE, BABY, DIE! SOON!

GLOBAL POLICIES TO SAVE THE SPECIES: ONE LOVE CLIMATE REFUGEES & PRISON COMMUNITIES ENCASE NUCLEAR REACTORS - ENCASE POWER POLES - CAP SIBERIAN AND ARCTIC METHANE - TRANSITION TO PRIMARILY SOLAR AND WIND - USING THE SAVE THE SPECIES - NON-DEBT BASED CURRENCY! EFFECTIVELY A NORDIC MODEL / RESOURCE BASED GLOBAL RENEWABLE ENERGY ECONOMY! - NOW! ALL POSTS (clickie) TOP POSTS: "THE LOGIC OF THE GOD OF LOVE!" MEDICARE FOR ALL - CHRISTIAN! CAPITALISM - EVIL! DO YOU CHOOSE - MONEY OR GOD! "MY HIS STORY" ANTARCTICA MELTING RAPIDLY! ANDRILL 2016 VIDEO - 60-75 FOOT SEA LEVEL RISE WITH 400 PPM CARBON, SAME AS TODAY, AND JUST SLIGHTLY HIGHER TEMPS THAN TODAY! "LIVING GIVING NETWORKS:" THE THEISTIC HUMANISTIC MODEL FOR ACHIEVING -"ONENESS" - WITH - "GOD'S LAW" - TO TAKE CARE OF - "THOSE IN NEED!" TO ACHIEVE "THE SHE MATRIARCAL NORDIC MODEL!" (not a business solicitation) "BECOMING ONE" CORONAVIRUS HELL ON EARTH! THEN - "HOT STUFF"- IS UNLEASHED! EXIT - THE GULF & FLORIDA - NOW! “THE MONSTER SUPER STORMS” WILL DESTROY THEM . . . . BY 2025! OMG! "GET YOUR SUCK BAGS" NOW! "THE HAMMER AND THE DANCE!" THE MOST HORRIFIC CASE. . . . . "It Is THE END!" WORLD'S ONLY MAJOR TERRORISTS GROUP! THE EVIL RIGHT WING! "AS IT IS IN HEAVEN - SO SHOULD IT BE ON EARTH!" SUPPORT THE ONLY CHRIST LIKE SOCIETY OR FRY IN THE HELL YOU SUPPORT! RIGGED - The GREAT SIBERIAN METHANE COVER UP! CAN "THEY" FIX IT? STOP HELL ON EARTH? "HOT STUFF LIVES?" The Clathrate Gun Fired FOR FULL SCREEN: Login to Youtube FIRST, then Open My Site, Then Click on Video you Want Full Screen. Now Go To Youtube, Switch Screens, Click on History, the First Is the Video You Clicked On - On My Site! If NOT close All, Repeat Process. MUST READ and WATCH The Nordic Theory of Everything / Love, and Anu Partanen’s writings Viking Economics: How the Scandinavians Got It Right - And How We Can, Too; The Secrets of The Nordic Model, by the same author, and The Nordic Perspective! US CORPORATE STATE SOCIALISM, Fascist Monopolistic, Homo and Transphobe, Racist, Kleptocratic / Thieves, Oil War Imperialist Focused, "ALL for THE RICH" - - "RAPE THE REST!" Especially Destroy the Lives of the Truly Good People Who Stand against THE EVIL GREED of THE FEW, The Sunshine Band. UNTIL The Horrific Demise of ALL God's Children, God's Species and Wonder Filled World for THE EVIL GREED OF THE FEW . . . . . . . . is EVIL! THE NORDIC MODEL: Libertarian Democratic Market Socialism: Denmark, Finland, Norway, Sweden, are Sustainable, Humane and Egalitarian (Think - SHE - The Matriarcal Nordic Model). . . . . . .it is GOOD! Vote for THE MATRIARCAL NORDIC MODEL - NOW! Jill Stein, Bernie Sanders, Alexandria Ocasio-Cortez - AOC, and The Squad 2024! VOTE! MY HEROS OF "THE MATRIARCAL NORDIC MODEL!" BELOW BERNIE SANDERS AND ALEXANDRIA CORTEZ 2020! IF NOT, JILL STEIN AND ABBY MARTIN - GREEN PARTY - 2020! "God's Girls!" "GG's Community," God's Gifted, think "The Beatitudes," is the Amazing Arts Colony We Will Be playing, singing, praising, loving, adoring God at Soon! Think billions of souls coming to see you, millions daily! Loving U!

MY HEROS, ABOVE:

LESTER BROWN, "WORLD ON THE EDGE," "PLAN B 4.0," EARTH-POLICY.ORG DR. GUY MCPHERSON, FATHER OF "ABRUPT CLIMATE CHANGE" DR. JORGEN RANDERS, FATHER OF "THE LIMITS TO GROWTH!" AND, "2052: A Global Forecast for the next 40 Years!" MICHAEL MOORE - DOCUMENTARIAN - FOR - "JC AND THE SUNSHINE BAND!" EXCEPTIONAL DOCUMENTARIES! RICK STEVES - THE NORDIC MODEL - THE GOOD LIFE! POSTER CHILDREN, BELOW: EVIL TRUMP! OF "THANK GOD!" - - "It Is THE END!" "HOT STUFF!" "THE SIBERIAN METHANE MONSTER!" "House of Trump, House of Putin: The Untold Story of Donald Trump and the Russian Mafia"

“Damning in its accumulation of detail, terrifying in its depiction of the pure evil of those Trump chose to do business with.”--The Spectator (UK) Watch "THE SIBERIAN METHANE MONSTER" - ABOVE - BURN UP and SUPER STORMS DESTROY Planet EVIL GREED! DAILY! OH BOY, WHAT COULD BE MORE EXCITING THAN THAT!? OK, Her Name is . . . . . . . "HOT STUFF!"

"The Limits to Growth: A Final Warning" tells you about the authors work since the early seventies, my work since 1980, and the stage of the "science of overpopulation analysis." Dr. Jorgen Randers, "2052: A Global Forecast for the Next Forty Years," and Lester Brown, "World on The Edge," have portended the fate of the world, due to overpopulation since the seventies! However limited I see their understanding of "abrupt climate change." Archives

July 2024

Categories |

||||||||||||||||||||||||

RSS Feed

RSS Feed